Global Economy

- Global economic growth continues but is expected to be slower than previously expected.- Downgrades to growth continue from major economic institutions and central banks around the world.

- The major contributing factors to lower economic growth are primarily geopolitical in nature and include the trade war between China and USA, which appears to be dragging on much longer than many anticipate, Brexit, which drags on with no sign of any agreement with the EU, potential US/Iran military action, US/Mexico trade tariffs that appear likely as Mexico is unlikely to stem the migrant flow, and Italy’s increasing budget deficit that is breaching EU limits.

- The geopolitical consulting firm Stratfor, forecast that 25% tariffs on Chinese and Mexican imports to the USA are likely to produce a reduction in global economic growth of around 0.8% within 2 years. That said, their most likely forecasts impact is still around 0.5% reduction in global economic growth.

Global Markets

- Downgrades to global economic growth by central banks and major economic institutions continue and bond markets have followed suit with significant reductions in yields around the world.

– Yields have returned to records lows in numerous countries around the world, and the US Federal Reserve Bank have moved from a rate tightening stance (from 2018) to strong expectations of a rate reduction during the second half of 2019.

- Whilst the June quarter produced good returns for most equity markets, it was quite volatile with most markets producing negative results during May … this appeared to be the equity market response to the trade war between China and USA.

Global Risks

- Looking ahead, global market risk continues to primarily lie with the above-mentioned geopolitical issues which are mostly driven by USA. Namely, continued Trade war between USA, China and USA, Mexico.

- Europe’s economy continues to be fragile and they have their own geopolitical challenges with Brexit, and Italy which includes their ballooning deficit, weakening banking sector, and fragile government coalition which will continue to cause problems with the European Union.

Australian Economy

- Australia’s economic growth has reduced to its lowest level since the GFC recording annual real GDP of 1.8%.

- Other economic statistics started to weaken over the last quarter, with inflation at a very low 1.3%, well below the RBA’s 2% to 3% target, and unemployment creeping up to 5.2% after reaching a low 4.9% in February.

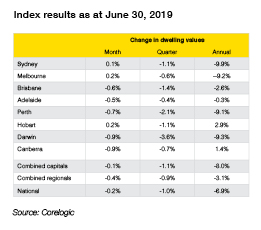

- The primary driver of the weak results has been the decline in housing markets across Australia which have resulted in loss of confidence, perceived wealth, and therefore reduced spending. Refer table below for housing price reductions to end of June 2019

Australian Markets

- The weaker Australian economic has resulted in the Reserve Bank making changes to its cash rate for the first time since August 2016. Both June and July meeting resulted in 25 basis point reductions down to a record low current interest rate of 1%.

- Bond markets have reduced their yields significantly and are also at record lows. At the time of writing, 2-year to 4-year bond yields are around 0.97%, lower than the cash rate, suggesting the market believes there is a strong chance of more Reserve Bank rate cuts.

- With interest rates at record lows, the sharemarket has looked more attractive and has produced a strong quarter with the S&P/ASX 200 total return index returning 7.97% to be amongst the world’s strongest markets.

Australian Risks

- Chinese economic success will be a major driver of Australia’s economic success for many years to come so continued Trade Wars between China and USA is a major risk to Australia in the short term.

- Many commentators are saying the worst of the housing slump is behind us, however this is off the back of very little data and assumptions of the impacts of the Reserve Bank’s rate cuts. Either way, the housing market continues to be a major risk and unemployment continues to the most significant indicator.

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026