Global Economy

- Until the weekend of February 22/23, the world thought the coronavirus was limited to China. Unfortunately, that weekend saw a massive rise in cases from Iran, South Korea, and the European epicentre, Italy. This was the first major sign the coronavirus is global resulting in the start of crashing equity markets around the world, rising credit spreads, and government action that has never been seen before.

- At the time of writing, almost 3 million people around the world have tested positive for COVID-19 with more than 190,000 deaths. Hospitals from the major economies of Europe, USA, and Middle East, and Asia, are barely coping with critical cases although thankfully the rate of new cases is declining thanks to social distancing and some stringent travel rules imposed everywhere.

- One of the many tragic consequences of this pandemic has been the effective shutdown of the global economy where industries from travel and accommodation, discretionary services, energy, have seen revenues plummet and the global economy is shaping up for the deepest recession since the Great Depression of the 1930s.

- Unemployment is expected to shift into deep double digits from North America to Europe and the reignition of the global economy appears to be only likely when there is the successful development of a vaccine, anti-viral medication, or the unlikely elimination of COVID-19 altogether. This is likely to take at least another 12-18 months. Until then, social distancing and a return to our previous normality appears unlikely.

- To prop up the global economy and financial markets, central banks around the world are implementing massive fiscal, and when possible monetary stimulus. One of the most recent being the announcement from the Federal Reserve Bank on 9 April of a $2.3USD trillion package in loans to support the economy. This provides liquidity to financial institutions to lend to small businesses, purchase up to $600bn of loans for small and medium businesses, and almost a trillion dollars of increased credit flow into credit markets … all massive support for high yield and credit markets.

Global Markets

- After declining by almost 25% from 24 February to 23 March which was cushioned by a declined Australian dollar, global equity markets (MSCI World GR) have bounced back with returns in positive double digits (reduced by an increasing Aussie dollar).

- Similarly Emerging Markets declined around 27% and have bounced back around 10% in the past few weeks.

- Bond yields have declined massively. The US 10-year bond yield started the year close to 2% and is trading around 0.6% at the time of writing. The Federal Reserve also took the drastic action of reducing its cash rate from 1.5% down to 0 to 0.25% range.

Global Risks

- Its all about coronavirus and how governments and its people respond. The biggest risk is a second wave of new case growth globally.

- The USA is currently the biggest concern with almost 900,000 cases and Trump appears to be talking about re-opening the economy which all health experts suggest is way too early. Opening too early is likely to create the second wave and push back any sign of economic growth indefinitely.

- There appears to be a lot of positive talk about a vaccine, but it appears there has never been a successful vaccine for a coronavirus so failure to create a successful vaccine creates economic uncertainty that would likely result in further financial market stress as governments run out of ammunition for stimulus.

Australian Economy

- Whilst the bushfires of the Australian summer were likely to create weak economic results, the coronavirus has pretty much guaranteed the first Australian recession since 1991.

- Like the rest of the world, Australia’s unemployment is rising sharply with current estimates around 10 to 15%. Government stimulus packages, e.g. Jobkeeper, have been amongst the strongest in the world and should cushion the unemployment increase. Unfortunately, it is unlikely to stop the increase quickly moving to 10% which is the first time since 1992.

Australian Markets

- The Reserve Bank has further shifted its interest rates downwards and they now sit at a record low , 0.25%. Couple with the latest decrease was their announcement to embark on some quantitative easing targeting the 3 year bond yield for also 25bps, which is currently trades near.

- The Australian sharemarket (S&P/ASX 200) has been hit very hard, like the rest of the world, and in the month following 23 February declined by almost 36% and has since rebounded with more than 10% return.

- The Australian dollar reached a low of $0.55USD and has since rebounded to $0.63USD … this movement is typical of volatile times and is likely to correlate with equity markets as their strong performance is likely to result in a rising Aussie and declining markets are likely to result in a shift to the safer US Dollar.

Australian Risks

- So far, Australia has coped much better than the rest of the world in terms of coronavirus cases and deaths. That said, this presents risks of complacency and the possibility of reverting to normality too quickly, thus risking a second wave.

- The Australian government is well placed for further stimulus with amongst the lowest federal government debt levels in the world … that is changing quickly so a weaker Australian dollar could create unwanted imported inflation.

Asset Allocation Summary

- Bond yields are low, equity markets appear expensive thanks to global government stimulus, and real assets are suffering from the global recession significantly reducing rents.

- The higher volatility and lower liquidity has resulted in very high transaction costs so without obvious buying opportunities it appears maintaining diversification and aligning the portfolio to longer term objectives appears most prudent.

- Whilst equity risk premiums had expanded into March creating some buying opportunities, they have once again closed up resulting in low future expected returns of all diversified portfolios, whether conservative or aggressive or in-between. Likely returns are probably single digit returns over the next 5 plus years.

- Equity markets are still priced and expected to outperform the less risky credit and bond markets over the long term (i.e. 5 to 10 years) but the current volatility is likely to continue for some time, meaning increasing portfolios towards risky assets must be prepared to accept this greater volatility and further downside risk.

- With Cash interest rates only marginally lower than Bond Yields, it appears Cash’s liquidity is attractive and it may be appropriate to hold surplus funds in cash in case of market further market declines or even to cushion economic losses, given equity market valuations don’t appear to match the economic stress before them

- Regular rebalancing of asset classes is generally recommended but care must be taken as transaction costs are significantly higher than they were last quarter.

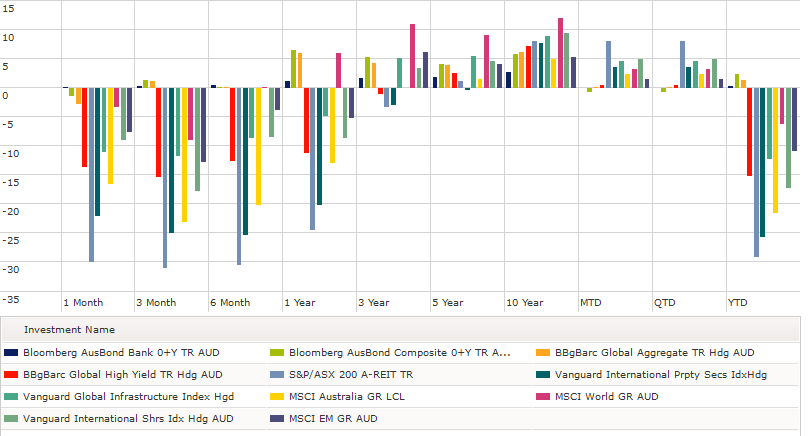

Asset Class Returns

(to 8 April 2020)

Source: Morningstar

- The halted global and local economy has resulted in all risky asset suffering massive declines with the worst performing asset classes over the past quarter being A-REITs (-31%), G-REITs (-25%), and the Australian equity market, MSCI Australia (-23%).

- Understandably the strongest performance wasn’t too strong with positive returns over the past 3 months coming from Cash (0.3%), Australian Bonds (1.3%), and Global Bonds (1.1%)

- Unhedged Developed Market equities has produced a positive return over the last 12 months (5.9%), thanks to the declining Australian dollar which was trading around $0.68USD at 8 April 2020.

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026