Everyone’s heard the saying “money can’t buy happiness,” but in 2025 with the cost of living soaring, many Australians might beg to differ. Between rising grocery bills, rent or mortgage payments, and inflation nibbling at our paycheques, it’s natural to wonder: how much money do you really need to feel happy and secure? The answer isn’t straightforward – it turns out happiness isn’t a price tag, but research and surveys give us some fascinating clues. In this friendly deep dive, we’ll explore what studies say about income and happiness for Australians, how financial stress and inflation factor in, and why mental wellbeing is about more than just the dollars in your bank account.

Money and Happiness: What the Research Says

Let’s start with the big picture. Research over decades has consistently found that having more money does boost happiness – but only up to a point. A well-known Princeton University study in 2010 suggested that day-to-day emotional well-being improved as income rose, until around US$75,000 a year (about A$110,000 at the time). Beyond that, extra money didn’t make people much happier. Adjusted for inflation, that “happiness plateau” would be closer to US$110,000 today, or about A$160,000.

Not all researchers agree on a strict cutoff, though. Newer studies have shown that well-being can continue to rise with higher income, but with diminishing returns. The jump in life satisfaction from earning $20,000 to $60,000 is huge, whereas the difference between $1 million and $2 million is barely noticeable.

One fascinating experiment in 2022 gave randomly selected people around the world a one-time gift of US$10,000. In poorer countries, that cash boost made a dramatic difference to happiness. In wealthier countries like Australia, the effect was smaller – yet still noticeable, even for households earning up to the equivalent of A$184,000. That suggests even at higher income levels, a bit of extra money can still lift wellbeing, though the impact fades as earnings climb.

The Happiness Income Threshold in Australia

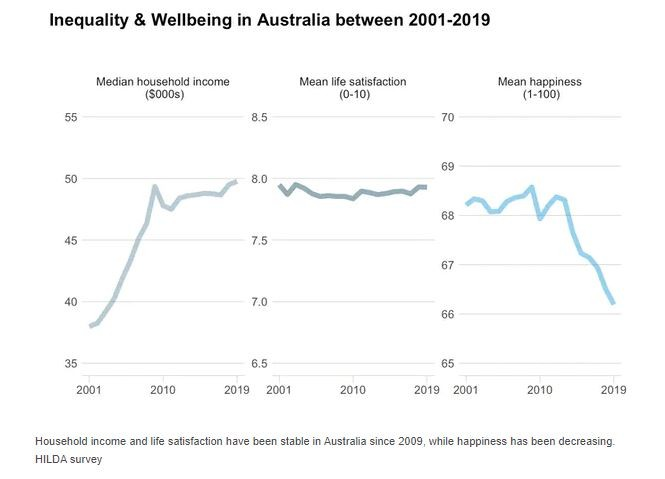

So what about Australia specifically – is there a magic number? Studies using Australia’s long-running Household, Income and Labour Dynamics (HILDA) survey found something striking: between 2001 and 2019, the income level at which additional money stopped contributing much to happiness nearly doubled – from about A$43,000 to roughly A$74,000 (after inflation).

Meanwhile, typical incomes haven’t kept up. The median personal income in Australia has hovered around A$50,000 for much of the past decade. This means a growing majority of people earn well below that $74k happiness threshold. Researchers estimate the share of Australians below the “happiness plateau” rose from around 60% in the early 2000s to nearly three-quarters by 2019. Put simply, happiness has become more expensive, and many people are being left behind.

Another quirky analysis in 2023 tried to put a price tag on “100% happiness” for Australians, factoring in our high living costs. It found that to be “fully happy” in Australia, you’d need an annual income of around A$190,000. That made Australia one of the most expensive countries in the world for happiness. Considering the median Aussie wage is about A$72,000, most people fall far short of this lofty figure – a reminder of how steep our cost of living has become.

Cost of Living, Inflation and Wellbeing

One big reason the income-happiness bar keeps rising is the cost-of-living pressures Australians face daily. Over the past five years, consumer prices have risen more than 20%, far outpacing wage growth. Essentials like food, petrol, and housing have all become much more expensive.

To tackle inflation, the Reserve Bank raised interest rates more than a dozen times between 2022 and 2023. This pushed up mortgage repayments and borrowing costs, adding hundreds – sometimes thousands – of dollars to monthly household budgets.

Financial stress is climbing. In late 2020, about 17% of Australians reported feeling significant financial stress. By early 2024, that had doubled to nearly 35% – roughly one in three people. Day-to-day, this stress can mean cutting back on groceries, cancelling family outings, or moving in with relatives just to make ends meet.

Financial Stress and Mental Health

Financial pressure doesn’t just pinch the wallet – it takes a serious toll on mental health. Surveys show more than half of Australians say cost-of-living pressures have had a major impact on their wellbeing. Around one in three report that money worries have significantly affected their mental health in the past year, leading to increased anxiety, stress, and depression.

Mental health services have reported record demand. Calls to helplines spiked in 2023 as people sought support for financial distress. Psychologists also note that financial issues now come up in a large share of therapy sessions, and cost itself has become a barrier to accessing help for many.

Studies show Australians experiencing serious financial stress are more than twice as likely to face mental health issues compared to those who are financially secure. It becomes a vicious cycle: money problems drive anxiety and depression, which in turn can make it harder to manage finances or work productively, worsening the problem.

More Than Money: Keys to Happiness and Wellbeing

So, does happiness boil down to your bank balance? Not entirely. Beyond covering essentials and reducing financial stress, other factors play a huge role in wellbeing.

How you spend your money is often more important than how much you earn. Experiences like travel, hobbies, and meals with friends tend to deliver longer-lasting joy than material purchases. Similarly, spending money to “buy back time” – for example, paying for childcare or cleaning services – can boost happiness by freeing up space for relaxation or family.

Relationships also matter enormously. A long-running Harvard study found that strong social connections are the single biggest predictor of a happy, healthy life – more so than wealth or fame. Investing in friendships, family, and community often yields greater happiness than climbing the corporate ladder for a bigger paycheque.

It’s also worth avoiding the trap of materialism. Chasing money for status can backfire, leaving people caught on a “hedonic treadmill” where each pay rise or purchase brings only temporary satisfaction before expectations climb again. In contrast, people who keep material goals moderate and focus on purpose, balance, and relationships report higher life satisfaction overall.

Finding Happiness Beyond the Paycheque

So, how much money do Australians need to be happy? There’s no single figure for everyone, but research suggests a few clear patterns.

-

Having “enough” to comfortably cover needs and reduce money worries is crucial. In Australia, that’s often quoted as somewhere between A$75,000 and A$120,000 a year per person.

-

For many households, rising costs mean they feel they need far more – even upwards of A$190,000 – to truly feel happy.

-

Beyond the essentials, though, happiness depends less on how much you earn and more on how you spend your money, how much time you have, and the strength of your relationships.

Money matters – there’s no denying that financial security brings peace of mind. But once your basics are covered, happiness is found in balance: time with loved ones, meaningful experiences, and a sense of purpose. After all, no one remembers their bank balance at the end of life – but they do remember the BBQs, the laughter, and the people who made it all worthwhile.

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026