This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

A month for cheaper or more defensive risky assets

- The global economy is spluttering along although USA appears relatively strong (2.8% growth), headline inflation is low everywhere thanks to energy price deflation, and markets see nothing but sunshine and continue to power along. The USA sharemarket the best performer again during November.

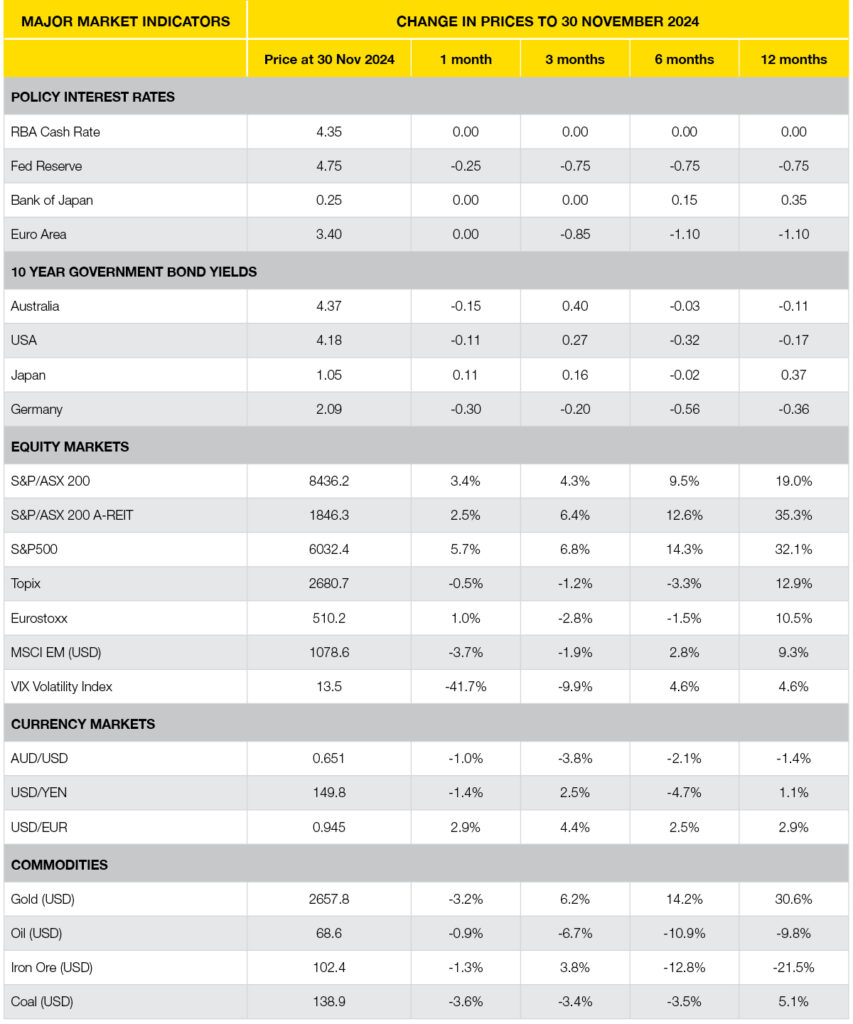

- The Federal Reserve dropped their cash rate by 25bps to 4.75% in November but the Reserve Bank of Australia remains unchanged. Markets suggest cash rates in both USA and Australia are likely to be in the high 3%s near the end of 2025 … so maybe only two or three rate cuts next year.

- The Trump election win means Tariffs are on the agenda and early signs are that it goes well beyond just China (USA neighbours, Mexico and Canda too!!). Emerging Markets didn’t respond well to the Trump win as they were down over 3% in November whilst Developed markets were up almost 5%.

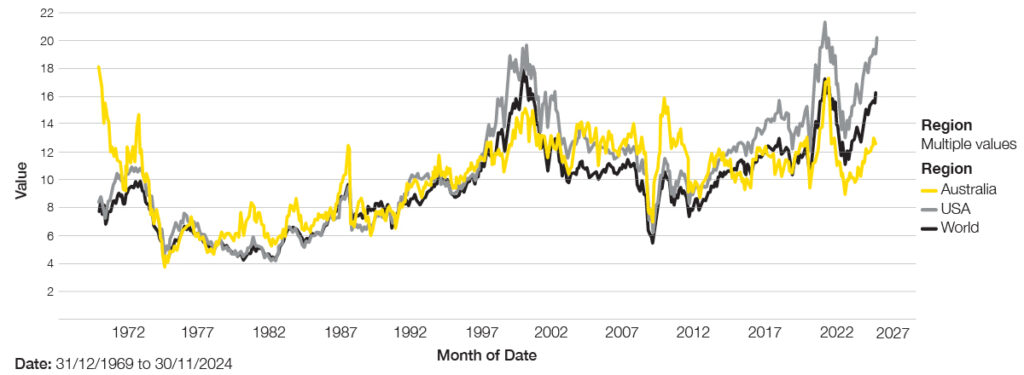

- Whilst feeling a little like the boy who cried wolf, we must reiterate that the US sharemarket is expensive whether historically or compared to other markets, and another 50-year Chart on the bottom of page 4 shows how expensive the USA’s market really is.

- The core investment message remains the same and is do not chase the strong performer, maintain diversification, rebalance, and prepare for potential volatility as economies adjust to a potentially slightly new Trump-influenced world

(although election promises rarely succeed).

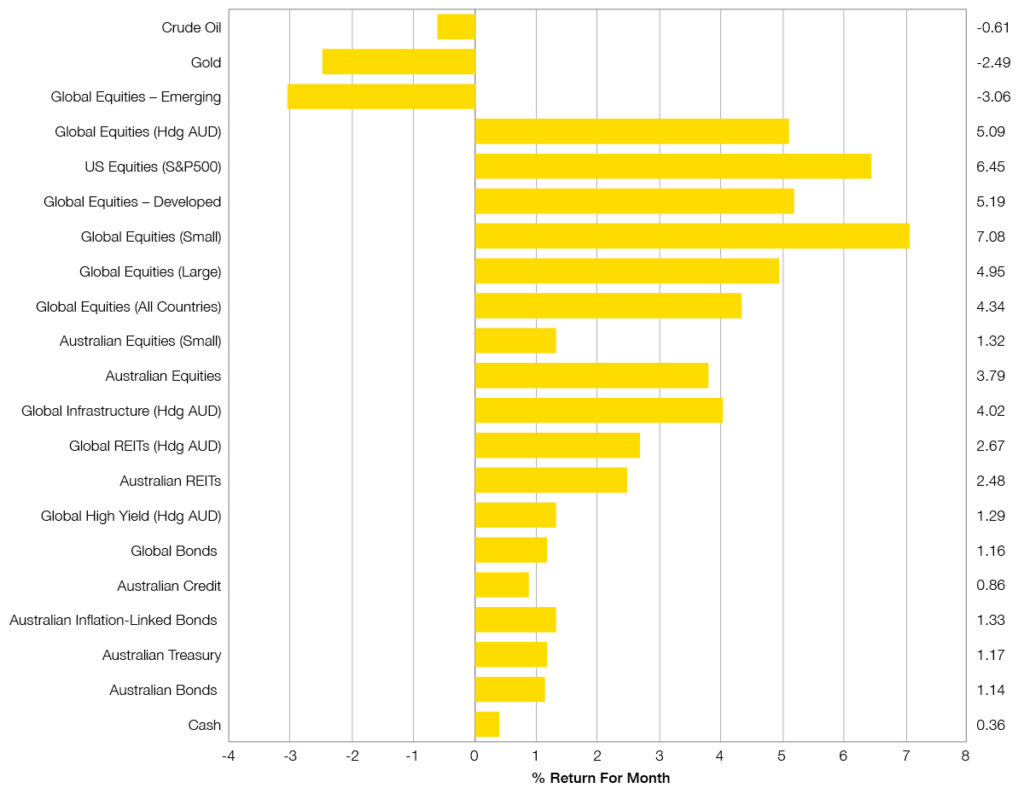

Chart 1: Trump is good for equities, but not Chinese equities Selected Market Returns in AUD Month to 30 November 2024

WHAT HAPPENED LAST MONTH?

Markets & Economy

- The Federal Reserve reduced their cash rate by another 25bps during November bringing it down to 4.75%. This was the only cash rate move during November amongst the major Central banks and rate cut followed another low-ish USA headline inflation result, 2.6%.

- It is worth noting, headline inflation is much lower around the world, but this is largely due to energy price deflation. The concerns for inflation are that energy prices could increase with escalation in the two major wars, a trade war from Tariffs, and/or the sustained high services inflation which is still over 4.5% in both Australia and USA.

- Economic growth continues to be generally weak around the world and in Australia (Australia’s economic growth is at 0.3%). The main driving economic force continues to be the USA as the previous economic force, China, splutters along, as its 0.9% economic growth is a shadow of its pre-COVID self.

- The Trump election win provided another boost for the US sharemarket and it gained more than 6% in November, bringing the 2024 performance to over 34%.

- The best performance during November came from the previous laggard, Global Smaller Companies, which gained a little over 7%.

- Whilst Trump’s election win was seen as a positive for US shares, his Tariff threat is not seen as good for Chinese shares, and Emerging Markets (of which China represents around one-third), were down more than 3% in November.

- The lower inflation results did help the bond market and Global Bonds were up a little over 1% (which is actually a strong month for bonds), and listed real assets (Property and Infrastructure) were also up strongly around 3% to 4%.

Outlook

- A new US presidency begins in January 2025 and there is still enormous uncertainty as to how much disruption or change in economic direction occurs. That said, it does appear Trump is all about disruption (considering his current list of hopeful executives), so it should be unsurprising if markets are volatile until it becomes clearer as to which of Trump’s promised policies become priority or actually achievable. A one-term Trump won’t be as easy as many think for putting any policy through.

- Tariffs appear to be the biggest threat to the global economy as they rarely provide growth but have been shown in the past to create short-term inflation, reduce competition, hamper economic growth, but positively, do favour local production. Time will obviously tell but a reduction in globalisation from a trade war, means the lower cost producer may be removed, so this inefficiency is likely to reduce global profits and increase sharemarket volatility. Under a high tariff regime, it is difficult to see valuations at current levels sustaining.

- As a result, the general portfolio approach is unchanged and centres on diversification. Whilst short term momentum in this “risk-on” environment may continue over the next few weeks or months, diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

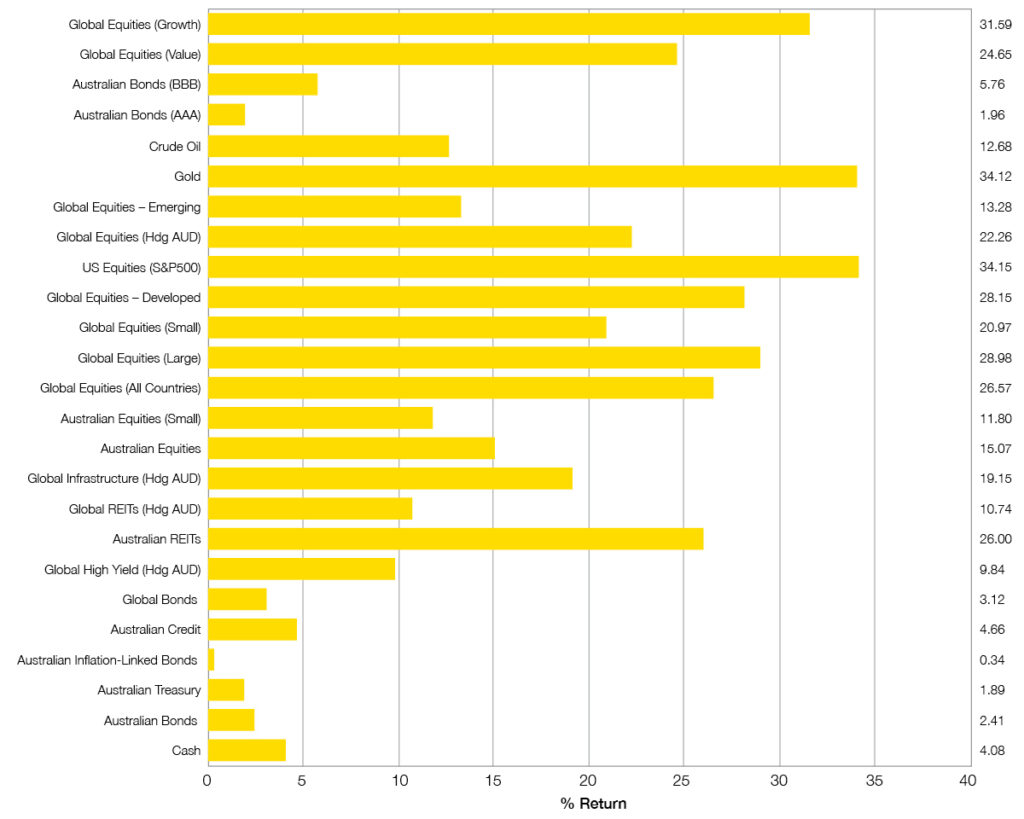

YEAR-TO-DATE ASSET CLASS RETURNS

Selected Market Returns in AUD – YTD to 30 November 2024

Australian REITs with the best performance over 12 months to 31 October with an astonishing 25% return.

Regional Comparison – Equity Market Indices

Price to Cash Earnings

Latest News Articles

Back to Latest News

End-of-Year Money Checklist: 10 Things To Do Before NYE

Redundancies in Australia Rising Quietly in White-Collar Sectors