This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

Risk off, Risk-on, Risk off, Risk back on again!!!

- After a poor December, all is forgotten and January returns are strong across all asset classes. Never mind the fact the US and European Bond markets have priced in recession during 2023, equity markets are strong and produced massive returns for the month that many may be happy for the year. Global (Hedged) and Australian equities all up over 6% for January!!!

- January was a “holiday” for all of the central banks but the first week of February provided interest rate increases by the Reserve Bank (up 25bps), USA’s Federal Reserve (up 25bps), and European Central Bank (Up 50bps), showing concerns about inflation remain and these banks are determined to further slow their respective economies…which is not good for equities.

- Looking ahead, our market expectations are unchanged from previous months although are slightly more negative on equity markets. Expectations include high investment market volatility across all asset classes as the global economy slows during the first half of 2023.

- From a valuation perspective, we prefer underweight positions in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

- High quality securities (defined by good profitability and strong balance sheets) may provide some recession protection.

- We are neutral on bonds as their yields are similar to Cash but believe Bonds will provide some protection to equity market volatility in 2023 as the horrible returns of 2022 are largely behind us.

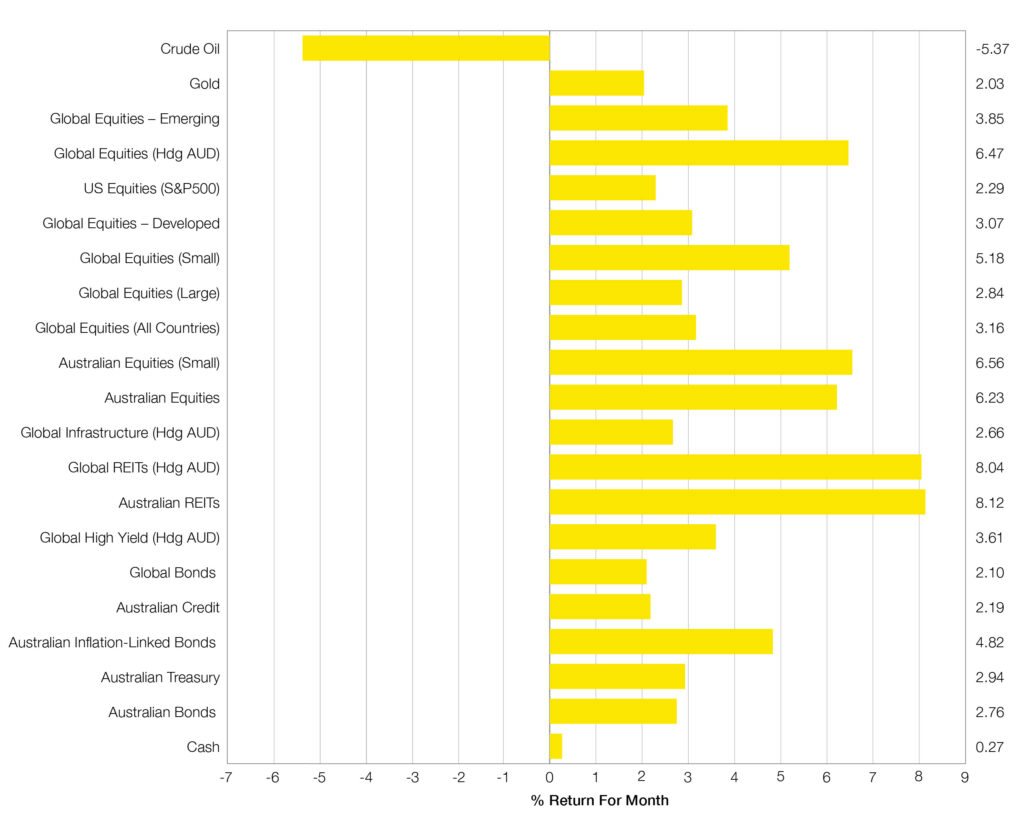

Chart 1: Hiding in Gold

Selected Market Returns in AUD – 31 December 2022

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

January effect

- Many investment courses talk about the January effect, which is one of those market anomalies that have persisted over the years without any strong rationale. Basically, the January effect is that equities have a tendency of performing strongly in the month of January and 2023 was no exception with most equity markets producing more than 6% positive returns.

- If there was some rationale it was a belief that inflation problems may be behind us. So interest rate hikes are slowing so the concerns of 2022 are no more. Given shorter term bond yields are only a little above cash rates in USA, Australia and elsewhere, this does suggest central banks are almost finished their hiking cycle and that inflation concerns are diminishing.

- The however, is that longer term bond yields around the world have dropped a lot (so bond market performance was strong during January) which many would argue is somewhat counter to higher equity markets. This is because declining bond yields (particularly long term bond yields that are lower than cash and short term bond yields) are strong signs of weak economies … and that should not be good for equities and other risky assets.

- Despite the continued weak economic outlook from the bond market, some of the major data is supported by the strong equity market. Unemployment continues to be low in the USA (only 3.4%), the same for Australia (3.5%), and the USA had very strong economic growth for the December quarter at 2.9%.

Outlook

What recession? … says the equity market?

It’s coming … says the bond market

- So, whilst all major asset markets (except Oil) produced strong returns for January, we believe the strength of equity markets has been a little too strong and err on the side of caution and prefer to rebalance or have underweight equity positions.

- The flatness of bond markets does not provide any strong preference for bonds over cash, so we prefer to be slightly overweight cash (or short interest rate duration) as cash interest rates are relatively high and they still appear to be increasing over the short term.

- Considering recession in the USA is still a strong possibility, erring on the side of caution also means we prefer higher quality bond securities over high yield as our expectations are that high yield securities will likely experience higher volatility, along with equity markets, as some of the economic data shows weakness as higher interest rates start to bite, via reported data.

- So our outlook is similar to last month and we have reasonable expectations that there will be:

- Downgrades in corporate earnings, increase in unemployment, weaker Australian dollar, and continued downturn (albeit at a slower rate) in property prices.

- Continued volatility for bond and equity markets … although the return outcome of bonds will not be as bad as 2022, whilst valuations are still high the same cannot be said for equities as there are still significant downside risks.

- Widening of high yield spreads and likely negative returns for high yield. High Yield bonds have continued to not acknowledge the likelihood of recession and although spreads widened in 2022, they appear far from levels that present reasonable risk.

- Value stocks to outperform growth stocks again as valuations of global growth securities (particularly in the USA) continue to be very high.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

Economic Snapshot – March 2024

New increased super contribution caps