This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

FEBRUARY 2025 IN SUMMARY

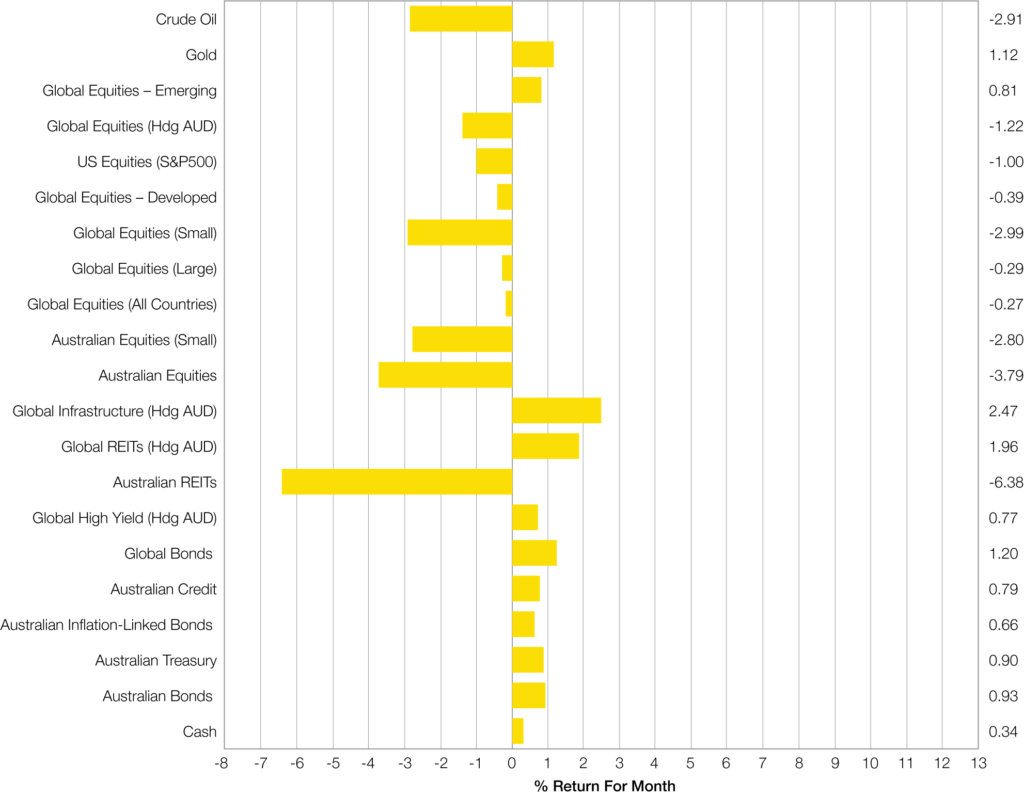

- A challenging month for sharemarkets as the Trump administration start issuing tariffs to so-called friends (Canada, Mexico), and foes (China). Sharemarkets initally responded negatively and then when tariffs were delayed sharemarkets reacted positively. Reimposed again, the tariffs resulted in sharemarkets going negative again.

- Whilst volatile, Global shares ended down only 1.2% (Hdg AUD) but the daily moves were often much higher.

- Australian sharemarket fared a little worse ending down almost 4%.

- This time bond markets were positive in price movement, but longer term yields declined mostly out of concern for the US and the global economy. 10-year bond yields decreased significantly in both Australia (12bps) and USA (32bps). Bonds are likely to return to their role as sharemarket diversifier although thanks to Tariffs, higher inflation has not disappeared yet.

- Inflation in the USA increased for the fourth month in a row to be at 3% which is above the Federal Reserve’s preferred inflation rate of 2%. Coupled with tariffs and a high expected inflation, there may not be too many rate reductions in the USA until inflation is a little lower or perhaps economic growth prospects weaken.

- The economic outlook around the world appears somewhat uncertain whilst there exists policy chaos and adjustment to the new US administration and their roll-out of tariffs to their trading partners.

- The core investment message remains the same and is do not chase the strong performer, maintain diversification, rebalance, and prepare for potential volatility as economies adjust to a the Trump-influenced world (although election promises rarely succeed). Major risks currently lie with expensive sharemarkets, particularly the USA, and global trade war as the USA ramps up it’s promised tariffs on friends and foes.

Chart 1: US dollar strength hurts global hedged assets most Selected Market Returns in AUD Month to 28 February 2025

WHAT HAPPENED LAST MONTH?

Markets & Economy

- The first full month of Trump’s presidency has seen plenty of chaos as tariffs were imposed on allies and foes, removed, and imposed again. The month finished with question marks around whether the USA is aligned with Russia or Ukraine … no one is really sure. Either way, there is a massive flurry of activity by Trump that is creating uncertainty affecting markets.

- Sharemarkets were very responsive to the Trump Tariff decisions and were very negative when imposed and very positive once removed. As mentioned in previous monthly notes, tariffs are rarely good for markets or economies as they are an additional tax that results in short term price increases that are ultimately paid by the end-consumer thereby reducing their capacity to spend on other goods and services.

- During February the VIX (Fear) Index increased by almost 20% as global and Australian sharemarkets declined. The Australian sharemarket declined the most, at almost 4%. This was not helped by the ASX reporting season that saw some softer than hoped results, like CSL.

- The best asset class performance during February came from fixed interest. Longer term 10-year bond yields declined in Australia (by 12bps), USA (by 32bps) and Germany (by 7bps) which assisted strong returns from Global Bonds (up 1.2%) and Australian Bonds (up by almost 1%). Lower Australian bond yields (and higher prices) were also assisted by the RBA providing its first rate cut since November 2020 – 25bps reduction to 4.1%.

- Major professional investment firms around the world are increasingly talking about the high valuations of USA sharemarkets which, as mentioned each month here, have been high for some time.

Outlook

- The Trump tariff action have understandably resulted in market volatility and considering the prospect of more tariffs is not going away any time soon, more volatility should be expected across all markets.

- USA’s withdrawal from many international agencies, international support (e.g. USAID), and perceived alignment with Russia also signals a changing of the world order as Europe and others will step up to fill this gap for Ukraine and the broader capitalist universe.

- Geopolitical risks are increasing with concerns of China taking advantage of the USA position and attempt to take back control of Taiwan – this may be very bad as Taiwan Semiconductor is one of the most important companies in the world for the manufacturing of computer related technologies.

- As a result, the general portfolio approach is unchanged and centres on diversification. Short term momentum of the “risk on” sharemarket has slowed but may re-continue over the next few weeks or months, diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels.

- Whilst the USA sharemarket has declined a little, it remains expensive, so significant downside revaluation risk continues. This is also the case with riskier fixed interest, such as USA High Yield (see Page 4), because their current price does not cater for their potential default risks should the US or broader global economy come under pressure.

- In Australia, markets suggest the RBA may not reduce its cash rate again until closer to the middle of 2025. The Australian sharemarket continues to be fully priced.

- Current 5-year return expectations of a typical balanced multi-asset investment with around 60% in growth assets is around 6-7%pa over the next 5-10 years.

- Overall, the general portfolio position is unchanged and centres on diversification. Volatile markets are likely to continue over the next few weeks or months and diversification continues to be essential in this environment, whether shares, bonds, real assets, as well as across regions and broader asset class levels.

Major Market Indicators

Sources: Morningstar, Trading Economics, Reserve Bank of Australia

TRUMPS TARIFFS ON CANADA, MEXICO AND CHINA WOULD COST TYPICAL US HOUSEHOLD OVER $1,200 A YEAR

Distribution of tax increases & reductions under Trump tariffs on Canada, Mexico and China announced on Feb 1 2025 and TCJA extensions, percent change in after-tax income

Source: pilie.com

ICE BofA US HIGH YIELD INDEX OPTION-ADJUSTED SPREAD – %

Source: tradingeconomics.com | Federal Reserve of St. Louis

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026