This article has been prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of the HPartners Group.

Summary & Investment Portfolios

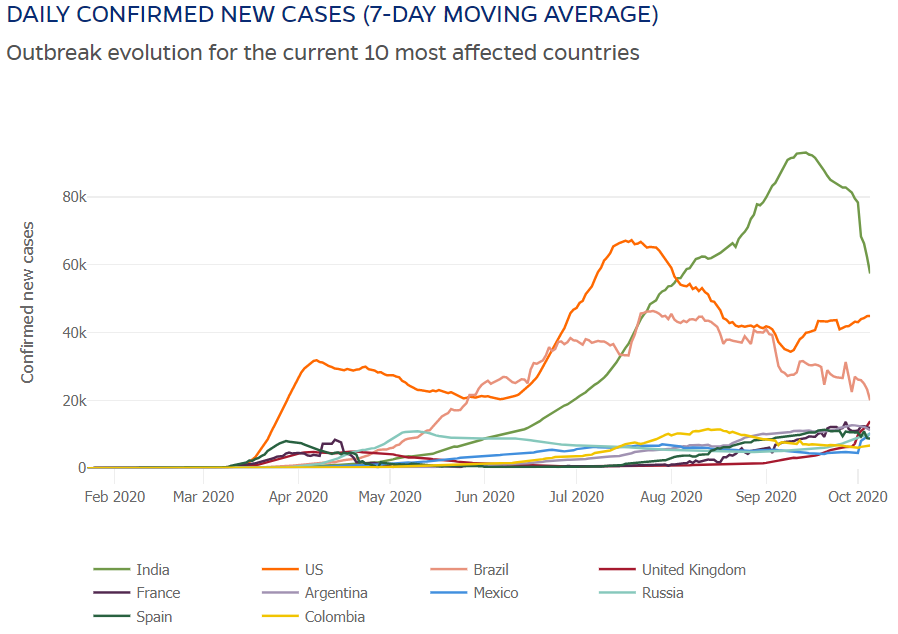

- Whilst Australia’s COVID-19 case number appears under control, cases continue to increase around the world with a potential third wave underway in USA.

- This may drag out the economic recovery and subdue equity markets

- Governments and central banks continue their stimulus efforts and positive talk and have little ammunition left. Fiscal stimulus is now required to combat any extended global recession although with high debt levels this is challenging for many of the weaker economies such as Latin American countries.

- Australia’s Federal Budget provided significant stimulus resulting in a couple of days positive returns for markets despite the same day sell-off in the USA. This may create positive momentum for the Australian equity market

- Included in the budget was reduced income taxes and infrastructure spend amongst others. The Australian government hopes to add almost 1million jobs over the next 4 years.

- With September demonstrating some higher volatility and declines in risky assets, there was expected to be some buying opportunities in equities. Alas, valuation continues to appear expensive so the continued slight defensive positioning is preferred accompanied by regular rebalancing across asset classes.

- Looking ahead, there has been very little shift in opportunities or expectations. Liquidity continues to be important and continued volatility is likely through to at least the US election when the uncertainty of future US policy direction will become clear.

- Broad diversification across asset classes and within asset classes continues to be a major theme and preference.

- Regular rebalancing continues in importance to maintain long term risk preference and return potential.

Pandemic

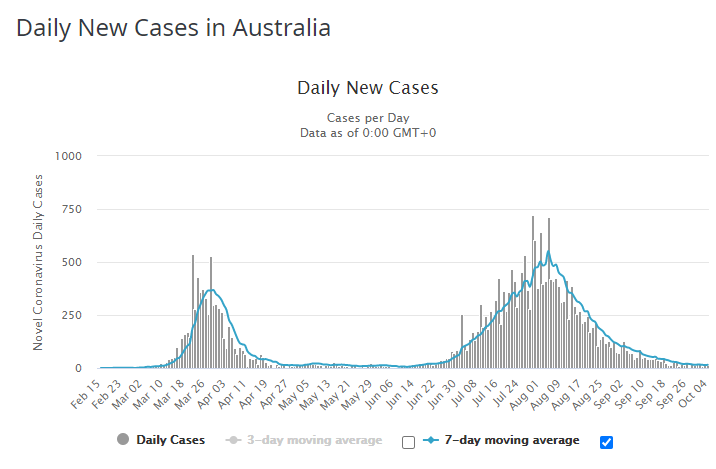

- Australia appears on top of its second wave of COVID-19 as Victoria’s hard lockdowns have flattened the curve. NSW and Queensland’s case concerns over the last couple of months have not increased substantially and both states are currently yielding very low numbers of positive cases.

- Globally, almost 36 million people have contracted COVID-19 which is an increase of almost 10 million since last month or an increase of almost 40%. Deaths have increased by more than 190,000 (or ~20%) and now tragically total 1,050,000. Deaths in the USA are over 210,000, are far above original estimates and are occasionally still producing death rates that are more than 1,000 per day.

- Whilst India and Brazil are experiencing declining numbers of positive cases, the USA appears to be entering its 3rd wave of increasing cases (see chart below) and this is probably not helped by a president who does not appear to have a plan. Despite contracting COVID-19, he continues to be in denial of its danger putting many at increased risk.

- Major European countries, including UK, France, and Spain, have increased restrictions amid a second wave that is largely getting out of control again.

- Other major hotspots around the world include Russia, and Latin American countries; Colombia, Peru, Argentina, and Mexico.

- It appears COVID-19 is a long way from being under control and a vaccine or effective treatment continues to be many months away.

Geopolitical

- US-China tensions appear to be on hold as Trump enters campaign mode, and his current COVID-19 recovery mode. These tensions will likely re-emerge although a Biden election victory is likely to result in a more diplomatic and less aggressive approach… but tensions will remain whether it be COVID-19-related, intellectual property rights, or South China Sea/Indian Border disputes.

- The US election campaign has temporarily halted as Trump and many of the Whitehouse staff have contracted COVID-19. Current polls indicate that Biden is likely to win which will clearly alter the current course of US relationships with many countries and regions including the EU and China. Whilst Polls indicate a Biden win, they have clearly had a poor record in recent years and the complexity of the US Electoral College voting system still means Biden will have to win key states such as Florida, Michigan, and Ohio (to name a few).

- The following chart shows the US Dollar has recently strengthened against the Aussie after indications by the Reserve Bank of taking more monetary stimulus.

Global Economy

- The global economy is recovering very slowly although continues its recessionary environment with the second wave of COVID-19 adding greater complexity around the recovery, suggesting the economic malaise is likely to continue well into 2021.

- A second or even third wave of COVID-19 is hitting USA and larger economies of Europe hard and restrictions are increasing, thereby guaranteeing slower economic recoveries

- Central banks around the world are already at or near record low cash levels and there appears little more they can do as the pressure shifts towards governments continuing their strong fiscal stimulus to ensure unemployment doesn’t get any worse and economies don’t collapse further.

- Looking ahead, it continues to be all about COVID-19 so the speed of economic recovery around the world will currently depend on the development and widespread availability of a successful vaccine and/or effective treatment.

- Lurking in the background continues to be tensions between China and USA and of course the results of the US election. Many analysts believe a Trump win is a positive for Wall Street but his ineffective approach to dealing with COVID-19 is surely having a deeper negative on the economy. Either way, current polling indicates a Biden win. Until then uncertainty is likely the norm over the next month or three depending on whether Trump accepts a loss, suffers worse effects from COVID-19 or surprisingly wins the election.

Global Markets

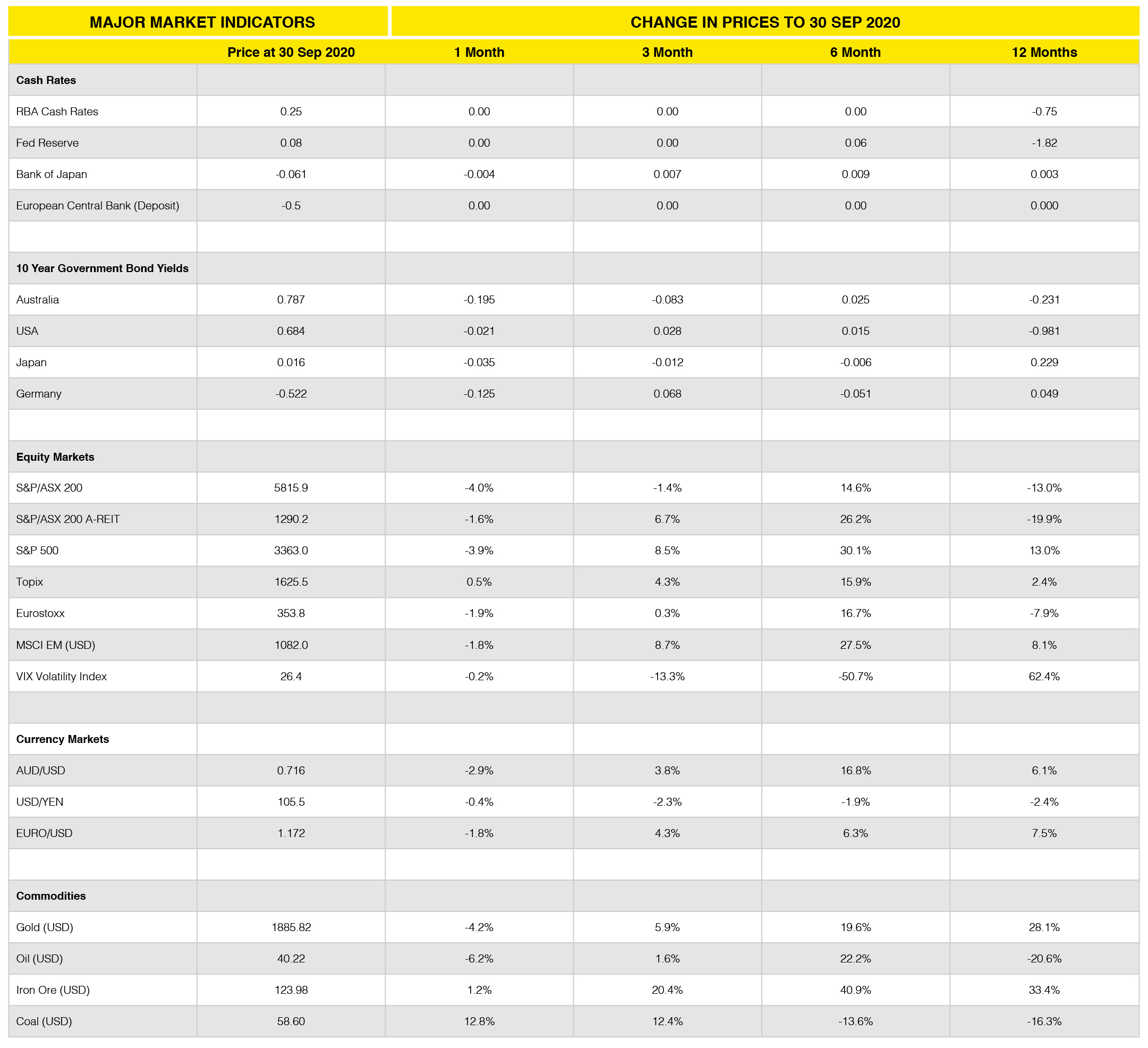

- Higher market volatility returned in September with markets mostly selling off and particularly the technology-dominant NASDAQ which ended up down almost 6%. This was somewhat unsurprising as the NASDAQ had increased an astonishing 60+% over the previous 6 months so some type of correction seemed overdue.

- The higher market volatility coincided with the second wave of COVID-19. At the time of writing, the second wave continues and the changing restrictions around the world are adding to the volatility as people are forced to change their spending habits.

- In the US, President Trump (straight out of hospital and positive for COVID-19) told his team to further stimulus talks with the opposition, Democrats, until after the election resulting in sharp falls on USA markets. With COVID-19 showing no signs of abating and a successful vaccine and treatment unlikely until 2021, markets likely to be hypersensitive to any news, positive or negative, around any fiscal or monetary stimulus news.

- Looking ahead, market volatility is likely to continue until at least the US election which should at least resolve some uncertainty about major economic policies. It is not uncommon for sharemarkets to rally after an election result and is largely to do with the reduction of uncertainty and therefore reduction of risk.

Global Risks

- The second wave of COVID-19 is the primary risk today and will be for many months yet, until a successful vaccine or more effective treatments become widespread.

- The US election adds significant uncertainty around future policy direction in the USA. Whilst the polls point to a Biden win, polls have lost their own credibility as they have increasingly been wrong in recent years and particularly the last US election when the polls pointed to a Clinton win. Either way, this uncertainty will be largely resolved on November 3.

- US-China relations are still fragile although appear on the backburner for the moment, although this is likely to be relatively short-lived.

Australian Economy

- Whilst Australia experienced a sharp near 7% economic contraction in the June quarter, this result was far better than most other developed economies around the world. Australia’s economic recovery is currently underway, although the second wave of COVID-19 in Victoria has resulted in an extended and deeper recession there.

- Unemployment in Australia surprisingly improved from 7.5% in July to 6.8% in August. Most economists are expecting higher rates of unemployment although are reducing their forecasts from near 10% to a much lower 8% peak, which is an excellent sign.

- The Federal government released its much-anticipated budget on the night of 6 October and announced significant fiscal stimulus measures designed to create almost 1 million jobs during the next four years. This will come at a budget deficit cost of around $213billion

- Some of the spending includes bringing forward income tax cuts to 1 July 2020, incentives for businesses hiring unemployed young people, infrastructure spending, and several billion dollars for manufactures, universities, and the CSIRO (to name a few).

- The government’s forecasts for the 2021 financial year include:

- Economic Growth +4.75%

- Unemployment 6.5% (down from current 6.8%)

- Inflation rate +1.5% (still below the RBA target of 2-3%)

- So, with strong government spending and an accommodative monetary policy from the Reserve Bank (i.e. low interest rates) all adding up to a stronger economy than it otherwise might be, Australia still requires the avoidance of another significant coronavirus breakout.

- Compared to the rest of the world, Australia has had good economic results and so far so good, but complacency around the virus is a clear risk.

Australian Markets

- The Reserve Bank resisted the urge to reduce rates from 25bps to 10bps at its October meeting but did indicate there may be more monetary stimulus applied at its next meeting. The current cash rate, 25bps, is a record low but RBA overnight cash rates continue to trade around 13bps suggesting lower rates are a real possibility.

- The Australian Government bond yields have also declined and 1 year rates are currently trading around 10bps and 3 year rates are at 13bps and well below the RBA’s targeted 25bps. The market is definitely expecting lower rates from the Reserve Bank and lower for longer too.

- Iron Ore has settled a little around $120USD/tonne and this high level has certainly assisted the government’s revenue and budget deficit. Unfortunately for the RBA, these high levels have also kept the Australian dollar relatively high (compared to pre-COVID) and it is currently trading around $0.71USD.

- The Australian sharemarket has been volatile along with global markets and ended up declining more than 3% in September. Over the past month, Energy securities have been hit hard along with Info-Tech but the latter has bounced strongly over the last couple of weeks.

Australian Risks

- COVID-19 is still Australia’s biggest risk, despite seemingly appearing largely under control. At the time of writing, Victoria is currently reporting average daily COVID-19 positive of less than 20 cases

- Global factors are also likely to strong impact Australia including COVID-19 second and third waves, US election, and China relations will all continue to be significant risks regarding both the Australian economic recovery and forward risk and returns of financial markets.

Asset Allocation Summary

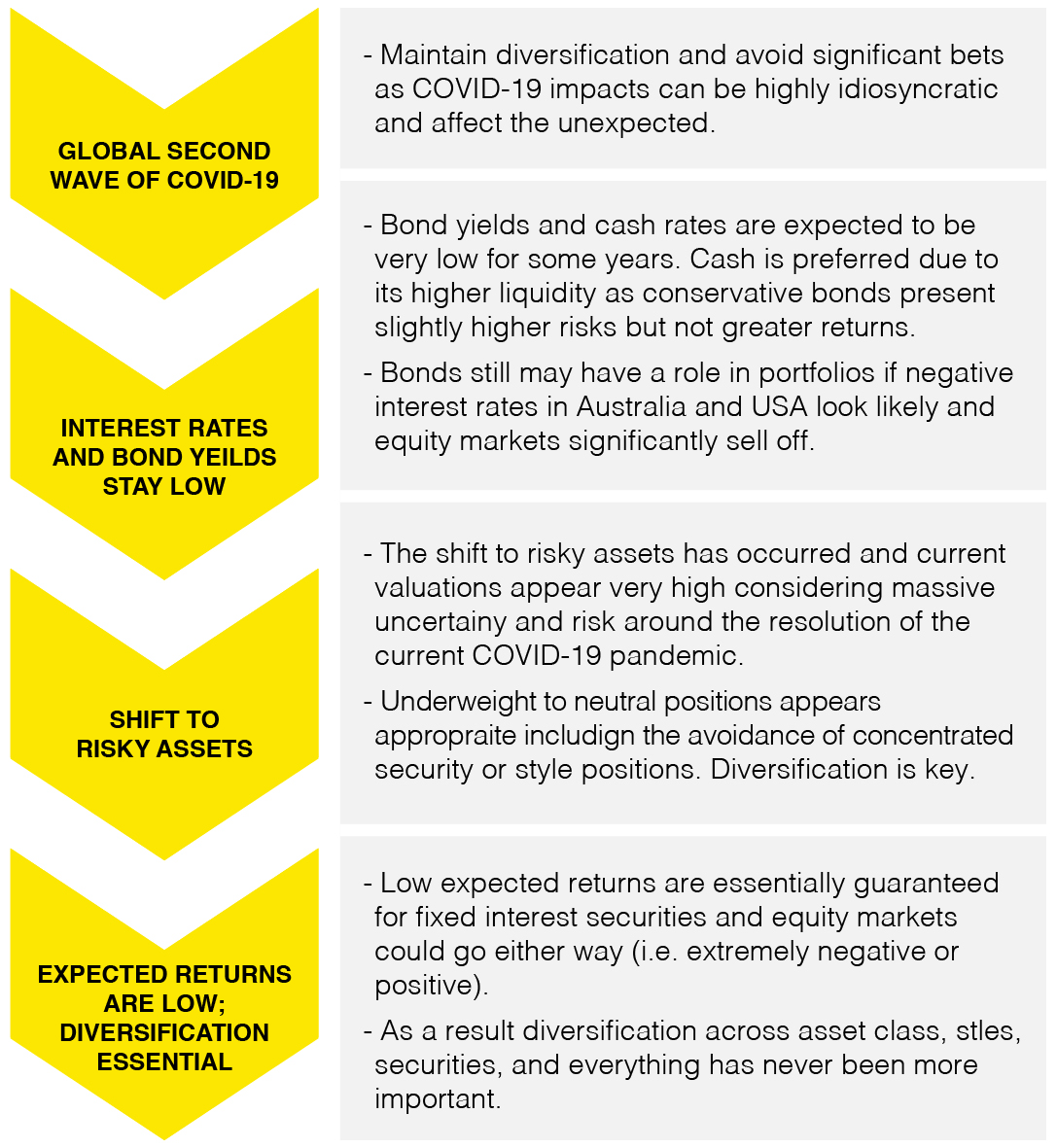

- Despite a small sell-off in equity markets during September, little has changed in terms of the outlook or strategic positioning.

- With record low bond yields and continued relatively high valuation for equity markets, all investor portfolios should be widely diversified across numerous assets and large single bets should be avoided.

- The future expected returns of all diversified portfolios, whether conservative or aggressive or in-between, are likely to be single digit returns over the next 5 plus years.

- Equity market valuations based on current earnings and book values appear very high considering the abnormal economics of the world.

- Bond markets are positioned for a long recession and/or recovery across the developed world and are at record low levels

- That said, the Federal Reserve is still likely to purchase high yield bonds providing confidence as the market buys higher credit risk investments. However, high yield credit spreads do not appear to justify the high default risk levels

- At this point in time, there does not appear to be any strong need to adjust the strategic asset allocation given the long-term focus, diversification across asset classes and within asset classes.

- Regular rebalancing of asset classes is recommended.

Major Themes and Solutions

Asset Class Returns (to 30 September 2020)

Source: Morningstar

- Most risky assets produced negative returns over the last month. The exception being Emerging Markets equities.

- With the Reserve Bank announcing potentially more economic stimulus, the yield curve dropped a little resulting in a strong 1.1% (yes, strong!) performance for Australian Bonds to be the best performer.

Appendix – Major Market Indicators

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026