Global Economy

- Current global concerns are centred on containment of the Coronavirus. Markets have been volatile at times and the Chinese economy is most impacted followed by China’s major trading partners, including Australia. The March quarter is expected to produce very weak economic growth results and if the coronavirus is contained sooner than later, there is likely to be a strong bounceback as trade returns to normal.

- The December 2019 quarter saw concerns over a global recession reduce as Donald Trump relaxed his rhetoric and proposed actions on the severity of the trade tariffs on China. This certainly doesn’t mean the trade war is over as there have been other trade tariff threats to other countries as we have somewhat shifted to a policy by tweet environment.

- There are expectations that Trump is likely to be less harsh on China than previously to ensure minimal economic damage in order to assist his election chances… this should help China’s economy in the short term

- Major economies in Europe are still growing but 12-month GDP Growth figures have hovered between 0.5% (Germany) up to 1.9% (Spain) for its major economies. The key concern for Europe continues to be how Brexit plays out and given the dominant win by UK’s Conservative Party, Brexit is now likely to occur sooner than later which will provide greater clarity and reduce risks for all key stakeholders.

- With the exception of UK, other major economies, Germany and Italy, have relatively unstable leadership given their political parties do not have majority control of their houses of parliament. Italy’s coalition government is a mishmash of different ideologies whilst Germany’s budget has such a low level of forecast spending, significant growth is unlikely. These governments appear unlikely to be effective in executing any growth so the rest of Europe continues its weak outlook.

- Looking ahead, uncertainty around the US elections, concerns around military action, and continued global trade tensions are likely to create challenges for the global economy but expectations are for continued global growth at similar lower levels to recent times.

Global Markets

- Further alleviating market concerns was the Federal Reserve 30 October rate cut, following its September 25bps rate cut. This was the 3rd rate cut in 2019 but also the third in a 3-month period. Reducing interest rates confirmed market expectations (coming via lower bond yields) but also means investors have to accept greater risks to achieve above-inflation returns.

- According to the governor, Jerome Powell, the rate reduction was done “In light of the implications of global developments for the economic outlook as well as muted inflation pressures”… in other words the Federal Reserve had concerns about the trade war’s impact on economic growth.

- The last quarter of 2019 saw strong equity markets and slightly higher bond yields which are a response to the improved rhetoric from Trump on the trade war. The coronavirus has resulted in bond yields declining again as economic growth expectations weaken.

- Developed market equities and Emerging market equities both returned more than 7% for the last quarter of 2019 whilst bond yields rose slightly and produced slightly negative returns.

- All asset classes appear expensive on historic basis but relative to each other, equities continue to trade at a reasonable earnings yield compared to the low bond yields. Low returns are forecast for all asset classes over the longer term (5+ years)

Global Risks

- In addition to the usual geopolitical tensions of recent times, whether Brexit and Trade War, the recent killing of a senior Iranian General by the United States has produced the real possibility of greater conflict in the Middle East region. This could be disruptive to financial markets depending on the nature of any conflict.

- In the US, the impeachment of Donald Trump and the 2020 elections are likely to create some new challenges … particularly markets responding to policy by tweet.

- The most recent disruption to the global economy is the coronavirus, which is halting travel into and out of China, and creating behavioural restrictions. This is likely to have a small and hopefully short-term economic cost, or at least until it is under control.

- Other risks remain unchanged … that is, Trade War between US and China/Europe/Mexico/et al. and, Brexit.

Australian Economy

- Australia’s economic growth increased slightly to 1.7% in the 12 months to September 2019. This still coincides with amongst the weakest growth since the GFC.

- Other recent economic statistics have been mixed, with inflation at a continued low 1.7%, well below the RBA’s 2% to 3% target, and unemployment steady around 5.2% (Nov 2019) which it reached around April 2019.

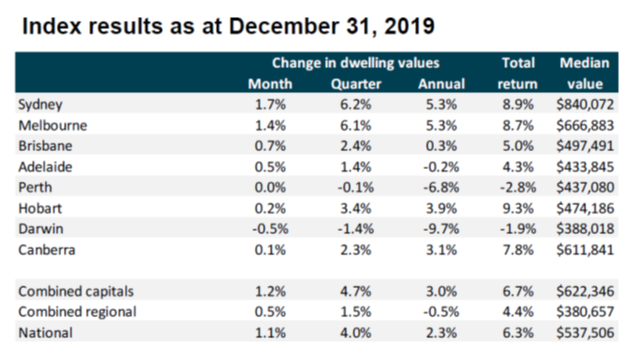

- Aside from Chinese concerns including coronavirus, housing continues to be a big talking point. The Reserve Bank’s rate cuts saw residential housing increase in price in the major centres, Sydney and Melbourne (up over 6% for December quarter), whilst the rest of the country was largely unchanged.

Source: Corelogic

Source: Corelogic

- Bushfires around Australia are likely to have a negative impact on the Australian economy over December 2019 quarter and likely the March 2020 quarter. This is likely to recover in following quarters as the rebuild begins. Either way, adding the impacts of the coronavirus to the bushfires means the March 2020 quarter is likely to be very weak for the Australian economy

Australian Markets

- Dissipating global recession fears and a bounce-back in Australian property prices saw the Reserve Bank put interest rates on hold over the last quarter. The next movement is still most likely to be down, but the relatively stable or mixed economic data suggests rates may be on hold for a little while yet.

- Australian equity markets were relatively flat after being the strongest performing market the previous 12 months but have started the 2020 year to be amongst the strongest markets in the world.

- The Australian dollar was trading close to $0.70USD but has declined as the economy is likely to be hurt by the coronavirus impacts. The previously stronger dollar was largely due to a slight increase in Iron Ore prices … which was most likely from an increase in Chinese demand.

Australian Risks

- Chinese economic success or otherwise be a major driver of Australia’s economic success for many years to come so continued Trade Wars between China and USA and coronavirus impacts are major risks to Australia in the short term. The recent coronavirus outbreak adds economic damage as tourism during Chinese New Year is reduced.

- China’s demand for our resources, like Iron Ore, continues to be important for the Australian government budget, Australian dollar, and this flows into the rest of the economy. Current Iron Ore prices have significant downside risks.

- Strong residential property market gains in Sydney and Melbourne may come as a relief given the previous declines. Either way, the housing market continues to be a major risk and unemployment continues to the most significant indicator.

- The tragic multi-state bushfires are likely to have a short term hit to the Australian economy before rebuilding begins.

Asset Allocation Summary

- With continued low bond yields and continued relatively high valuation for equity markets, all investor portfolios should be widely diversified across numerous assets and large single bets should be avoided.

- The future expected returns of all diversified portfolios, whether conservative or aggressive or in-between, are likely to be single digit returns over the next 5 plus years.

- Equity markets are still expected to outperform the less risky credit and bond markets over the long term (i.e. 5 to 10 years).

- It is acknowledged valuations are relatively high for risky assets, however, defensive assets have long run expected returns of less than 2%pa.

- Defensive asset valuations may lead towards greater portfolio shift to risky assets, and continued strong bouts of volatility

- Bond markets continue to be positioned for weak economic growth across the developed world and have sustained at low yields seen a few years ago in the US, whilst Australia and Europe continue to test record lows.

- Conservative bond allocations reliant on interest rate risk may be reduced in favour of investment grade, shorter duration, and/or corporate bond allocations.

- The lower bond yields have created very strong returns for real assets such as real estate investment trusts, infrastructure assets, and gold. Future return expectations of these asset classes may be strong in the short-term compared to other asset classes as investors look for higher yielding assets. That said, they are unlikely to be as high as recent years.

- The significant reduction in yields around the world means higher risk is most likely required to sustain returns above inflation. As a result, an underweight position in secure, long duration bonds appears appropriate for longer term investors and a slight shift towards shorter duration credit and/or equities. This assumption means inflation is likely to continue at current low levels.

- Regular rebalancing of asset classes is highly recommended.

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026