This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

Volatility is back

- Higher for longer appears to be the mantra of central banks resulting in higher long term bond yields (so decline in bond prices), declining sharemarkets, and punished real asset prices (generally due to their higher debt levels).

- Cash levels and shorter-term debt prices were steady but the possibility of higher or sustained cash rates also increases economic growth concerns.

- One of the drivers of higher (cash rates) for longer are higher energy prices. Since the end of June to end of September, Crude Oil futures have increased from ~$70USD (Bbl) to over $93USD (Bbl) which is a more than 30% increase. Energy prices are a major driver of inflation as they affect everyone’s back pocket whether household, corporate or government.

- The Australian dollar weakened off the back of this risk-off month and has been trading around $0.63USD again. This provided a slight cushion to declining unhedged global equities.

- Whilst expensive US markets have underperformed in September, there appears to be more to play out yet. Ongoing high volatility for all markets (bonds, real assets, or shares) is expected.

- High valuations (i.e. USA shares) and slowing economies continue to be a time for caution and portfolios continue to be positioned for this with overweights to style biases such as quality and value preferred.

- Diversification over concentration, and higher than usual cash holdings appears most prudent.

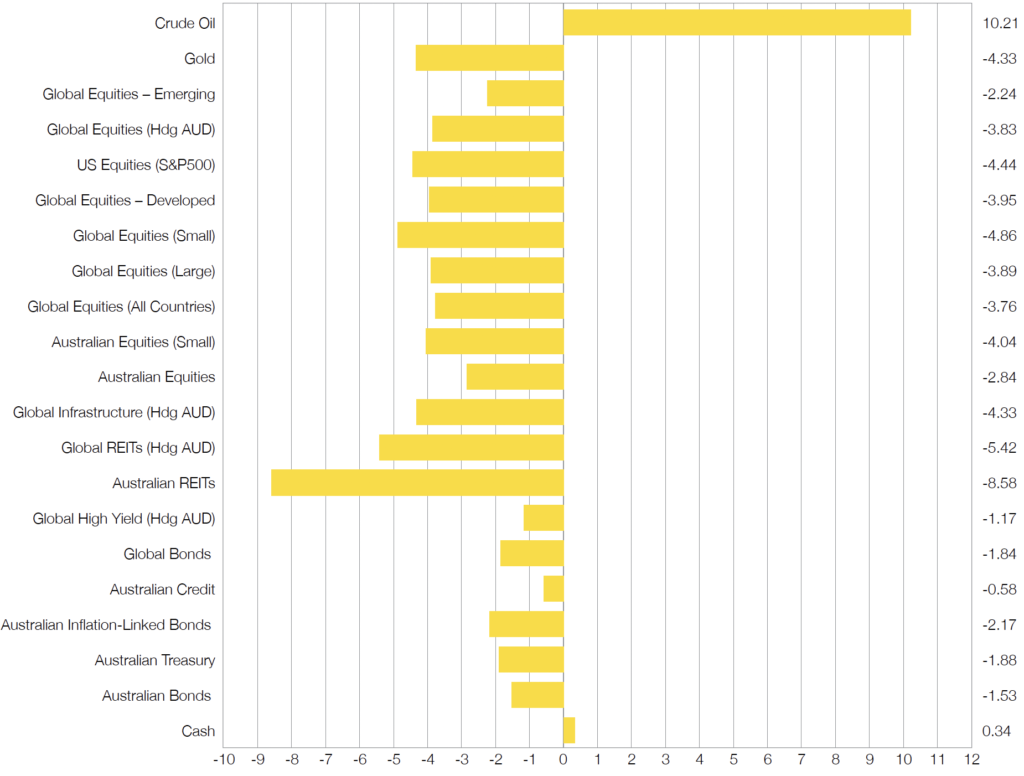

Chart 1: Rising Energy prices resulting in sustained inflation concerns

Selected Market Returns in AUD – 31 September 2023

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

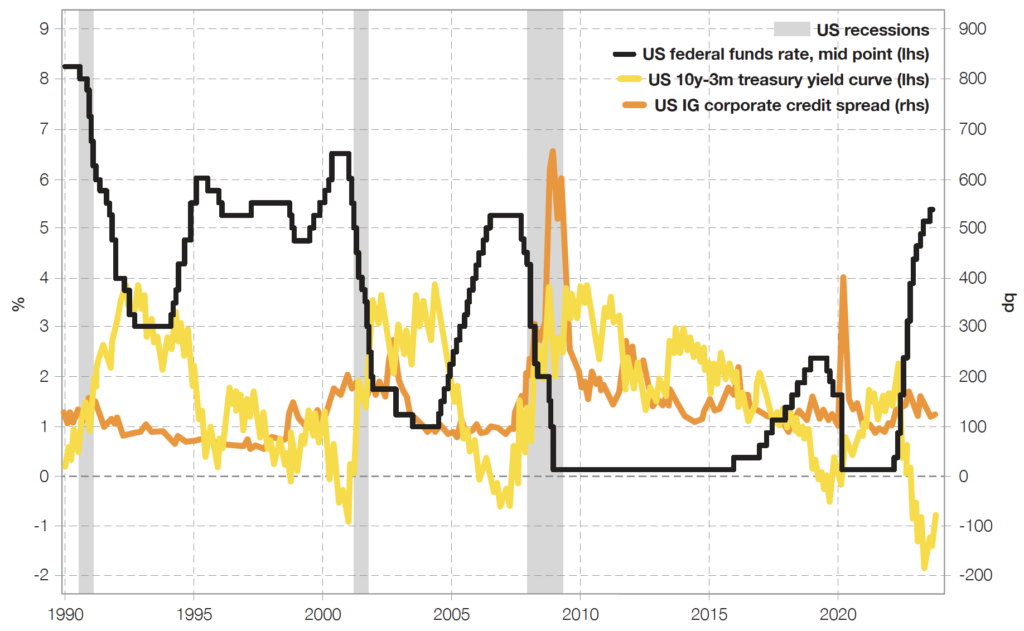

Yield disinversion … strangely increasing recession risks

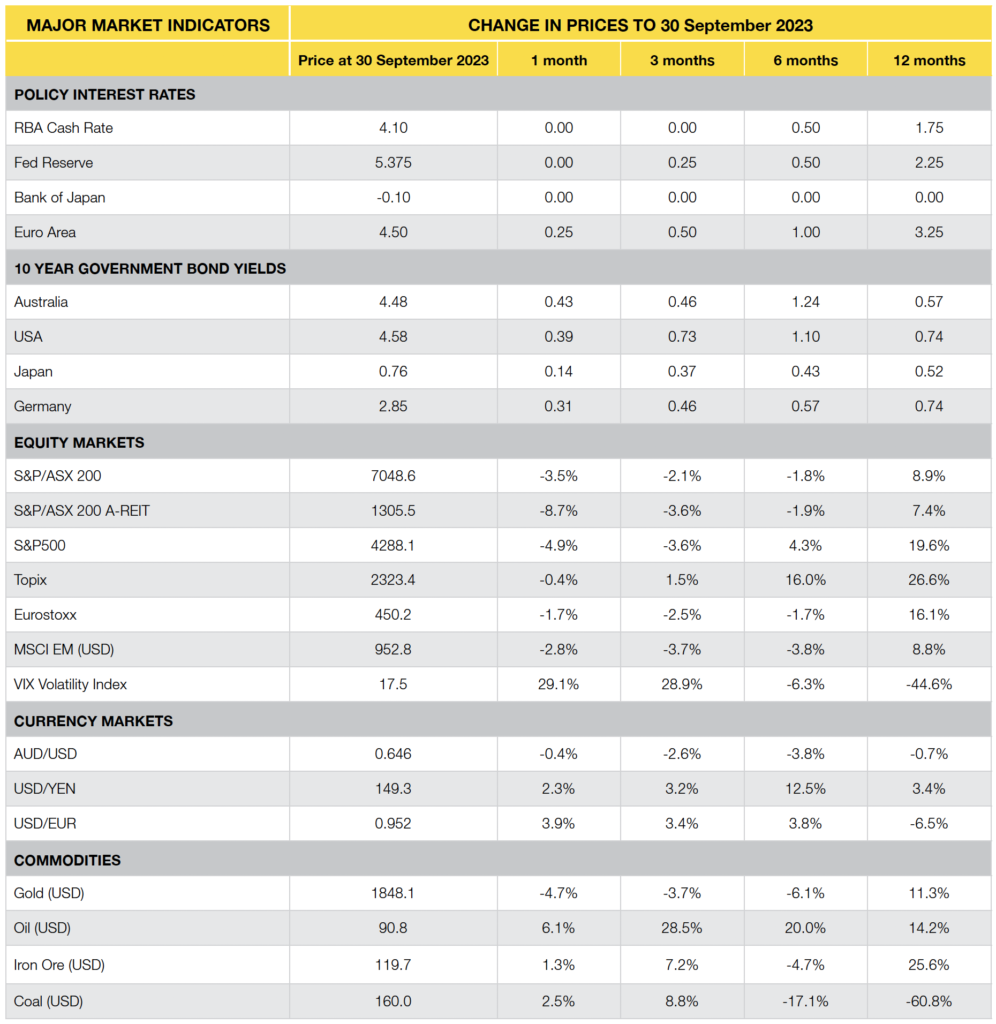

- Over September the 10-year bond yields of US & Australia increased massively … up 39bps to 4.58% in US and up 43bps to 4.48% in Australia. Whilst shorter term cash and treasury bills under 1 year barely moved at all and stayed around 5.5% in the USA, and 4.1% in Australia. This “yield disinversion”, which is the reduction in the long yields minus short term yields spread, is called a “bear steepening” when it is the longer-term yields increasing as opposed to the shorter-term yields decreasing. The “Bear” label appears because it often occurs prior to recession (refer Chart on Page 4). Because the shorter-term yields are not decreasing this suggests the US Federal Reserve (& RBA) are likely to leave their cash rates higher for longer, which is not helped by the high energy prices (refer Oil price gains in Chart 1 and Page 3).

- Consistent with a “bear steepening” was a large sell-off in risky assets during September (and into the start of October). Most affected by higher yields are real assets and Australian REITs, Global REITs, and Global Infrastructure each declined substantially (down 8.6%, 5.4%, and 4.3% respectively).

- Of course, rising bond yields means lower bond prices and often lower valuations and Australian, Developed markets, and Emerging markets also declined significaintly (down 2.8%, 4.0%, and 2.2% respectively).

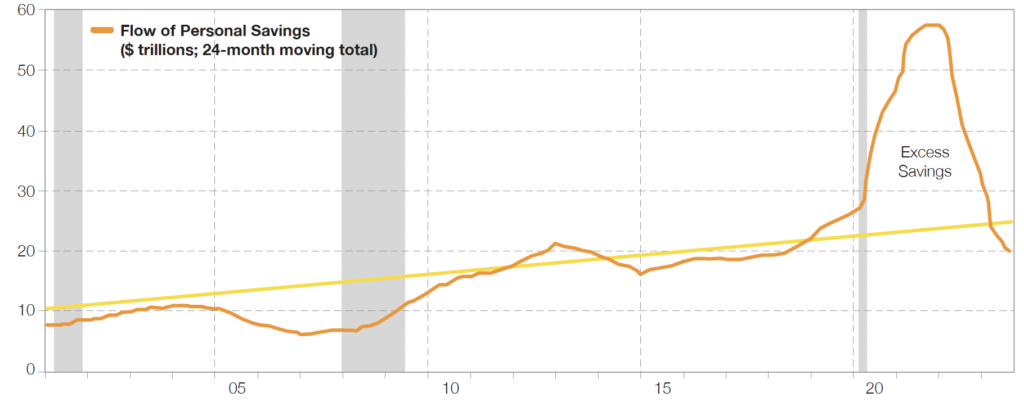

- In terms of economic data, the US jobs market continues to appear strong, inflation crept up a little to 3.7% from 3.2%, and there was no update on economic growth across the major economies. That said, economic leading indicators such as confidence, bank lending, credit card usage, and debt servicing strain to name a few, show recessionary signs for the USA.

Outlook

Bear steepening

- After an incredibly strong start to sharemarkets in 2023, a weaker August and September should not come as a surprise. Leading economic data continues to appear weak, and this “bear steepening” is of concern that, if nothing else, means that rates are going to stay higher for longer placing stress on indebtedness and will still slow the US economy (& our own).

- So, whilst picking short-term market direction is virtually impossible, continuation of this overdue sharemarket volatility is more than likely.

- Investment markets priced at greatest risk continue to be the growth heavy US Tech market and higher yielding US corporate bond market. Whilst high yield spreads are tight (and therefore expensive), one positive is the high energy prices are supportive as the energy sector is a large proportion of the US High Yield market.

- With Bond yields at their highest levels since 2007, they are once again more attractive than recent times and considering the yields are above most inflation expectations, investors should not be concerned about holding bonds if focused on the long term. Of course, they could still decrease in price over the short term if this momentum continues. Cash remains king for now given this higher for longer theme.

- Finally, with the Australian dollar around $0.63USD, increasing or rebalancing hedged sharemarket exposures appears prudent, as this is 20% below long-term averages.

- All of that said, our bias towards value, quality (whether bonds or equities) continues to be appropriate along with the avoidance of concentrated bets in favour of diversification.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Will the yield curve disinversion cause a US credit spread widening?

Sources: Gavekal Research

Will the yield curve disinversion cause a US credit spread widening?

Sources: Gavekal Research

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026