This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

Volatility continues … this time to the upside

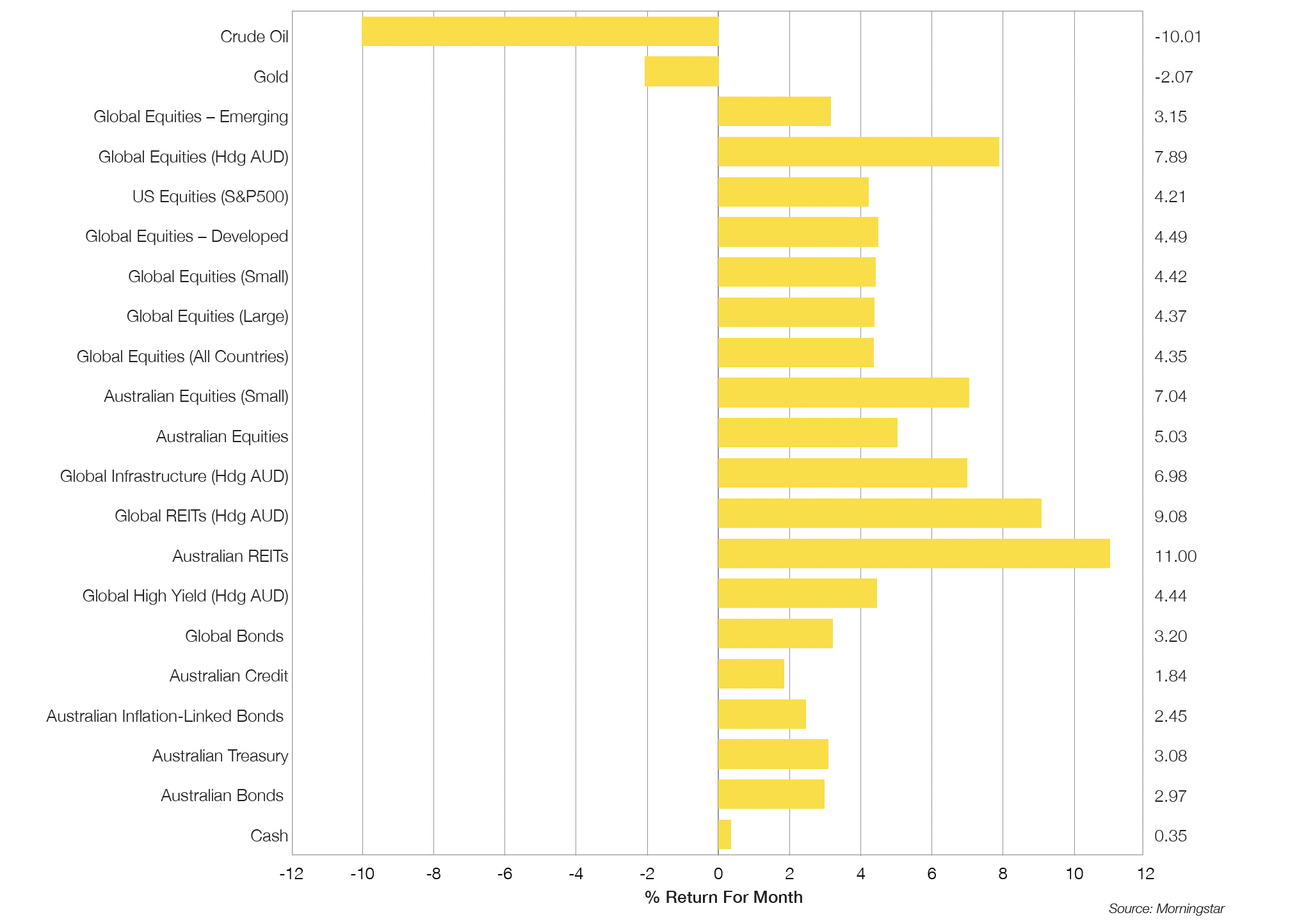

- With the exception of Gold and Oil, all major asset classes bounced back with strong returns for the month of November. (Chart 1)

- USA’s inflation decreased again after a few months of increase, and was largely due to the lower energy prices. Australia also experienced a sharper decline in inflation than expected, but both countries continue to have high services inflation which was the major reason for Australia’s RBA increase in cash rates last month.

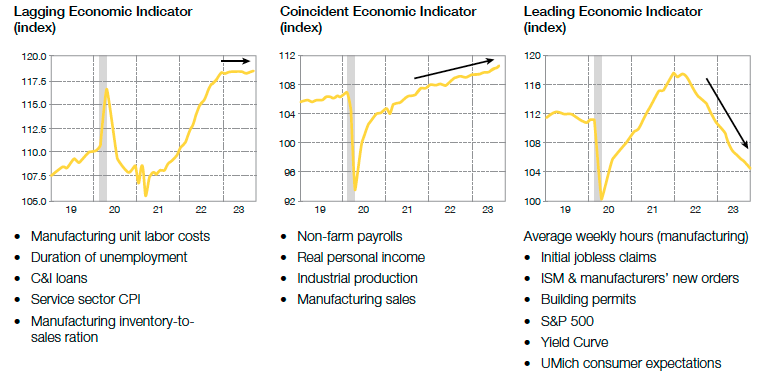

- Despite some strong economic results, many leading indicators continue to point to weaker economic growth in both Australia and USA whilst Europe and China’s economies are currently much weaker than desired. China has reduced its cash rate and is providing additional stimulus to reverse their current deflation.

- The current market volatility is likely to persist in Australia and USA as economic growth slows during 2024. Bonds have increased sharply in price last month and as central bank focus shifts from inflation to economic growth in 2024 they are expected to provide greater diversification to the sharemarket than seen over the last couple of years (where the focus is inflation).

- Looking ahead, our portfolio approach remains unchanged. Diversification not concentration with a preference for higher quality and the avoidance of expensive growth securities at any price (i.e. US Tech) … refer Page 4 for “data support”.

Chart 1: Almost the complete opposite of October

Selected Market Returns in AUD – 30 November 2023

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

Strong markets and mixed economies

- Despite the continuation of two wars without strong prospects for stopping, most traditional investment markets produced strong returns, reversing the weakness that started in July. Catalysts of reversal were not strong but mostly came from lower inflation in the USA which returned to July levels and the subsequent belief the Federal Reserve may have stopped their rate increases. The next step from the Federal Reserve is likely a decrease as economic weakness becomes the focus.

- As mentioned last month, leading indicators in the US (particularly consumer focused ones), were weak suggesting economic slowdown. Despite that, economic growth for the September quarter came in with a strong 4.9% annualised result (annualising a quarterly result is a fax pas, but that’s apparently what they do now).

- In Australia the RBA increased it’s cash rate by 25bps at the start of November and kept it on hold at their December meeting. Services inflation continues near its highest levels since the turn of the century (a little under 6%) and this must decrease. At the time of writing markets expect one more 25bps increase which is most likely to occur February or March 2024. What may stop the rate increase is weak economic growth and the September quarter’s results for Australia was a weaker than expected 0.2%.

- China continues it’s battle to stop deflation with both fiscal and monetary stimulus, and their latest economic growth results (1.3% for Sep qtr.) are weaker than the USA’s.

Outlook

A long-term view means we sometimes sound like a broken record

- The message remains largely unchanged which is the continuation of market volatility as US economic growth inevitably slows into 2024.

- Bond prices have increased significantly and November was their best month in many years. We expect bonds to provide greater diversification to the sharemarket into 2024 as the focus shifts from high inflation to concerns about economic weakness comes to the fore.

- From a sharemarket valuation perspective, there isn’t a great deal of change despite several months of weakness. Investment markets at greatest risk continue to be the growth-heavy US Tech and Growth market (refer Page 4’s chart) and the higher yielding US corporate bond market.

- High Yield spreads are currently near their lowest since interest rates starting increasing in 2022 and higher yielding corporate bonds do not currently appear to provide good value.

- All of that said, Cash rates are unlikely to decline in the next few months and an overweight position continues to be appropriate as economic risks start increasing.

- Investing with styles that favour value, quality (whether bonds or equities) continues to be appropriate along with the avoidance of concentrated bets in favour of diversification.

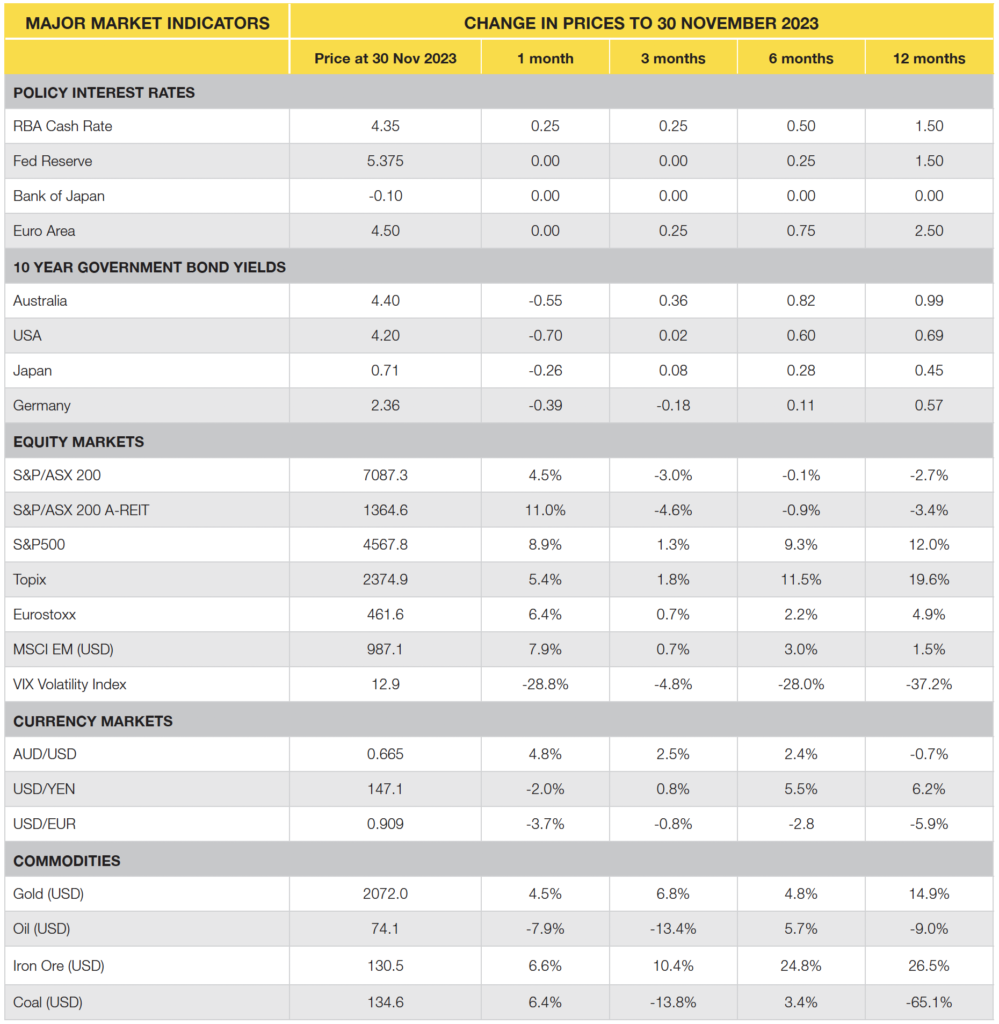

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Chart 2: S&P normalised P/E vs. subsequent annualised returns (since 1987, forecasts as 11/17/23)

Sources: Schroders

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026