This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

Banking collapses lead to credit slowdown in short term

- The collapse of America’s Silicon Valley Bank (SVB) and the giant Credit Suisse Bank put the high interest rate, high inflation regime into perspective … i.e. you never know what is around the corner. That said, with the exception of Australia’s bank-heavy sharemarket, overseas sharemarkets produced strong returns during March, and Bond yields collapsed resulting in price increases.

- Despite the strong performance, major economies continue their low unemployment, and show current economic strength suggesting higher interest rates may continue and increase recession fears despite newspaper rhetoric of the opposite.

- Looking ahead, our market expectations demand caution on equity markets as valuations do not reflect recession possibilities. SVB may be the start of left field market shocks, and should lead to a serious reduction in short term credit supply, so we expect more investment market volatility across all asset classes as the global economy slows during 2023.

- From a valuation perspective, , we prefer to be underweight in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

o High quality securities (defined by good profitability and strong balance sheets) may provide some recession protection. - High quality securities (defined by good profitability and strong balance sheets) may provide some recession protection.

- We have shifted to a preference for shorter duration in debt markets as bond yields reduce to well below cash interest rates but, unlike recent times, still believe Bonds will provide protection to equity market volatility in 2023. DIVERSIFICATION IS A MUST.

- From a valuation perspective, , we prefer to be underweight in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

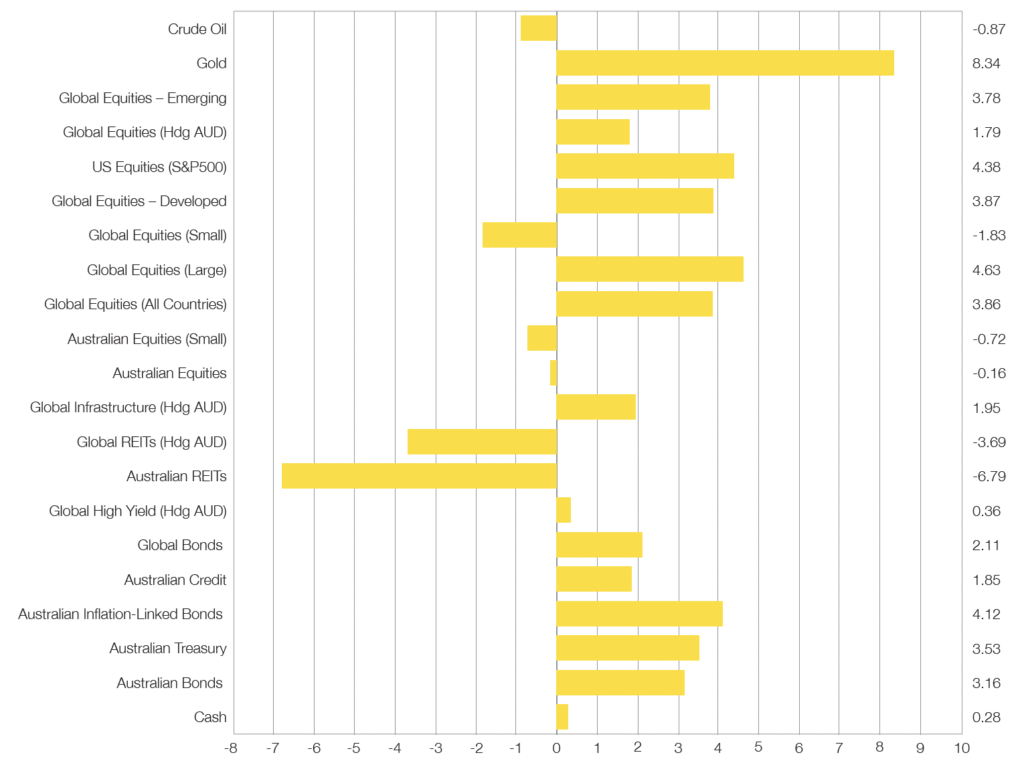

Chart 1: A strong month for most asset classes, except REITs & Small Companies

Selected Market Returns in AUD – 31 March 2023

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

Apparently, there was a banking crisis???

- Overall, it was a relatively strong month for overseas share markets. The US-broad market index, S&P500, was up by more than 4% (in AUD), the MSCI World (in AUD) up by a little under 4%, and the MSCI Emerging Markets (in AUD) also increased by a little under 4%.

- Meanwhile the local S&P/ASX 200 returned -0.2%. This relative underperformance by the Australian sharemarket was largely to do with the collapse of several banks in the USA plus the Swiss giant, Credit Suisse. This is because of the dominance of Australian banks in the S&P/ASX200 where they comprise around 40%.

- The collapse of Silicon Valley Bank (SVB) was initiated by a bank run of large uninsured depositors who were concerned of the bank’s losses from investments in government bonds which suffered following interest rate rises. The massive amount of withdrawals resulted in the bank unable to pay these depositors because they ran out of cash and most bank’s assets are typically held in illiquid mortgages. This happened in several other small and medium US Banks, resulting in the US government’s insurance program securing depositor’s money with a promise of payment.

- Other market responses to this bank crisis were a large decline in longer term bond yields both in the USA and around the world (including Australia) and explains the large positive return in March from Global Bonds (2.1%) and Australian Bonds (3.2%) … because when rates go down prices go up.

- A likely consequence of this US Small to Medium banking crisis is that credit amongst these banks becomes tight now and for the coming months as these banks will look to repair their balance sheets by rebuilding their deposit books before lending. This is likely to add to headwinds to the US economy on top of the higher interest rates in the face of persistent inflation. That said, the US economy continues to produce strong employment adding to inflation concerns.

Outlook

Continued sharemarket caution

- The first quarter of 2023 has started very strongly for most risky assets, and particularly for the tech sector. This exacerbates our previous equity valuation concerns in the face of higher interest rates and potential US recession in the latter half of 2023 … so we remain cautious of equities, prefer the cheaper “value” style securities, and expect volatility across all financial markets.

- Increasing cash rates by central banks is still likely to continue despite the recent (April) pause by Australia’s Reserve Bank and signs of slowdown by the Federal Reserve. Inflation is still high and to combat inflation is at the cost of the economy as rising debt costs decrease purchasing power. Increasing global recession risks will continue.

- Valuations risks continue to be greatest in US Equities and this is our continued preferred underweight equities market. That said, it will be challenging for all equity markets in the short-term, so the current portfolio preference is for an underweight allocation to equities or preference to using conservative equity strategies (e.g. low volatility).

- Whilst long-term bonds have had a very strong month in March, they are yielding well below cash rates and our current preference is for shorter than market duration. As recession risks increase further longer-term bonds usually tend to perform well but March saw a sharper than usual yield decline following the mini-bank crisis. Current yields of around 3% for 1 to 10-year bonds in Australia are obviously much lower than the 3.6% cash rate in a high inflation regime.

- As stated in previous monthly statements, what is essential for all portfolios today is diversification across asset classes and securities with a focus on the long term. Whilst it’s a challenging environment over the short term, current valuations across all major asset classes continue to suggest a balanced portfolio is likely to return over 7%pa over the next 10 years.

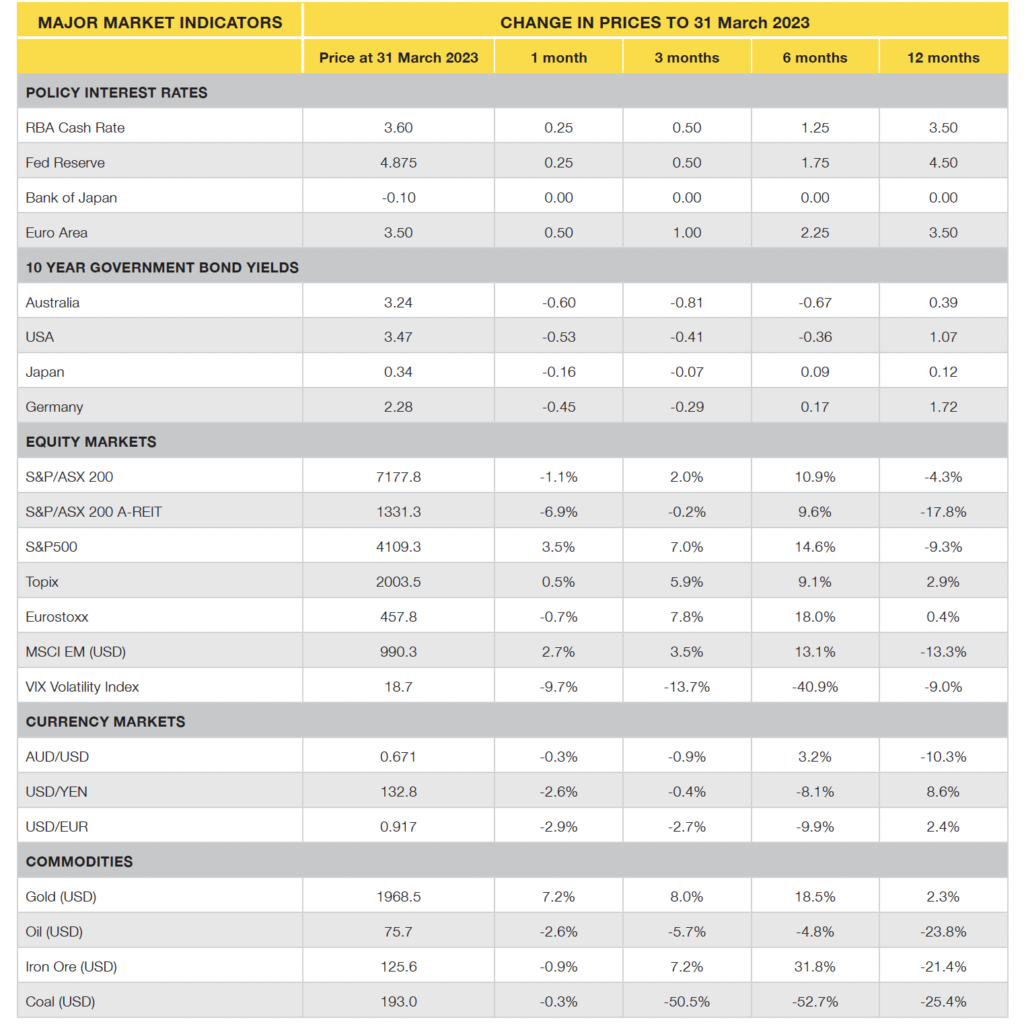

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

Economists Flag A Tough 2026 as Interest Rates to Rise Again

Redundancy Isn’t Just a Job Loss – It’s a Financial Shock