This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

A pause for bonds and US equities continue on

- Three months in a row of strong returns from sharemarkets although with central banks suggesting rates are not coming down as soon as everyone thinks, means inflation continues to be a little problematic and will likely contribute to the widely expected economic growth slowdown in 2024.

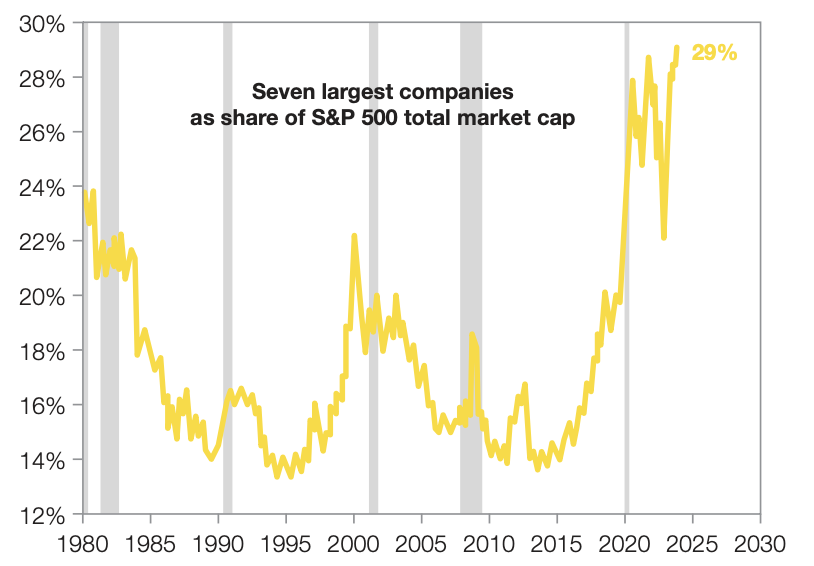

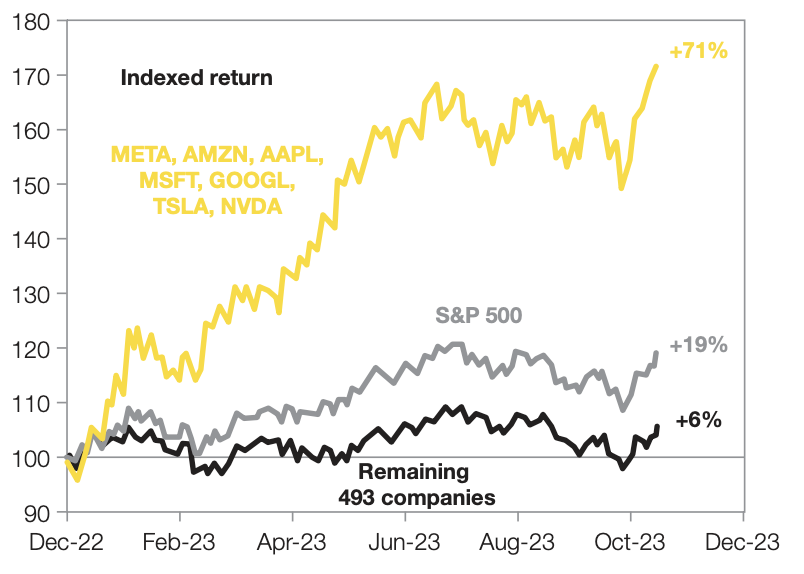

- Large US tech stocks (Microsoft, Apple, et al.), currently known as the Magnificent 7, comprise almost 30% of the S&P500. This level of concentration is somewhat rare and high. In the USA they produced a 71% return in 2023 compared to the remaining 493 stocks that returned only 6% … that is a divergence that would seem highly unlikely to continue. That said, their performance continued to be strong in January leading the S&P500 to higher levels still. Momentum appears to be the factor of success when investing in current times.

- Despite the US Sharemarket suggesting everything is great, US Bond Yields are still negatively sloping (which was an 8 from 8 recession predictor). As mentioned, economic growth slowdown is expected in 2024, accompanied by lower cash rates … but not yet as inflation is still a little too high and the economic data is not quite bad enough.

- We believe any economic slowdown may affect the more expensive parts of the market more than others and this includes US sharemarket (or growth section) and High Yield bonds. With both bull and bear market signals everywhere, there are no obvious places to invest, just places to avoid. As a result, portfolio preferences continue to be towards diversification core asset classes and securities. In other words, avoidance of concentrated bets … particularly on strong recent performing assets.

Chart 1: Momentum maintained across all asset classes to finish the year

Selected Market Returns in AUD – 31 January 2024

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

The US juggernaut continues

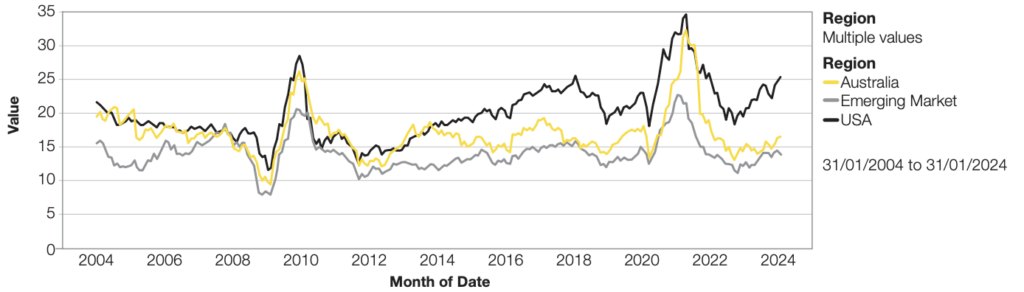

- The US sharemarket continued its incredible run to start 2024 on a very positive note. The S&P500 returning just under 5% in Australian dollars for January and this led the developed market index, MCSI World, to a strong 4.5% return. Growth stocks continued to be the main driver, and their valuations are up to levels usually associated with correction levels.

- The tech success has had an array of acronyms over the years from FAANG to MAMAA and now it’s the Magnificent 7. This includes Microsoft, Apple, Meta, Alphabet, Amazon, Nvidia, and Tesla. In the original Magnificent 7 movie, four of them died, so hopefully this doesn’t happen to these enormous companies given their influence in everyone’s daily lives.

- After bond yields declined very sharply from October to December, they took a breather in January, and returns were generally flat. This flowed into the longer duration (i.e. interest rate sensitive) asset classes of Global REITs (i.e. Property), and Global Infrastructure, that ended the month with performance down around 2% and 3%, respectively.

- The current rhetoric coming from central banks is that their cash rates will not be declining as fast as markets were expecting, and we know fast declines are only likely if there are serious economic headwinds, and recession. Whilst an economic soft landing appears to be generally agreed for the US economy, the negative bond yield continues to predict recession but so too do many prominent economists. Caution is still a prudent approach.

- Inflation is dropping sharply across USA, Australia, and Europe, but continues at higher levels than desired so its not over yet. In Australia, the latest 4.1% figure for December was encouraging but still too high. Services inflation at 4.6% is still somewhat concerning. Nevertheless, it is most likely the RBA will keep rates on hold in the coming months.

- Aside from USA, China continues to stimulate their weak, deflating economy, and Europe is mostly in recession.

Outlook

Complacency the risk

- 2024 is generally expected to be a weaker global economy than 2023 and may support lower cash rates in the second half. That doesn’t mean it’s time to increase allocation to risky assets as a weaker economy is often a difficult time for risky assets. Therefore, diversification continues to be essential.

- Whilst potentially sounding like a broken record, sharemarket valuations are near record highs in the USA, and particularly amongst the big tech companies, so long-term upside potential must be limited. Please note, this comment is specifically for the long-term … anything can happen next month!

- Bond prices have increased significantly, paused in January, and we expect them to provide greater diversification to the sharemarket in 2024 as the focus shifts from inflation to the economy.

- As previously communicated, High Yield securities are not yielding much more than conservative bonds so do not appear to provide good long-term value.

- With Cash rates yielding higher than bonds, cash still appears to be king for now.

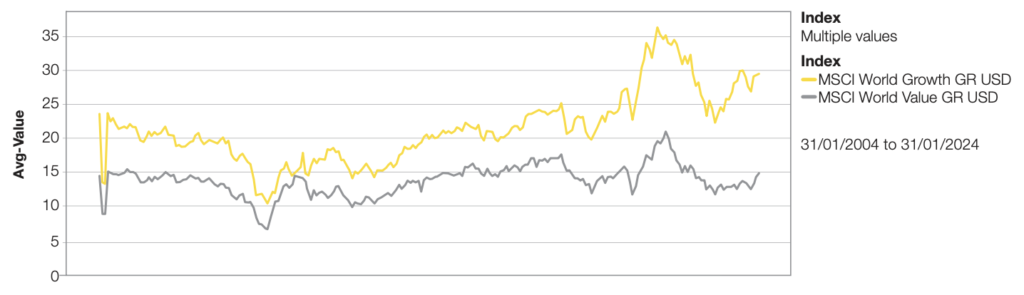

- Investing with styles that favour value, quality (whether bonds or equities) also appears appropriate along with the avoidance of concentrated bets in favour of diversification.

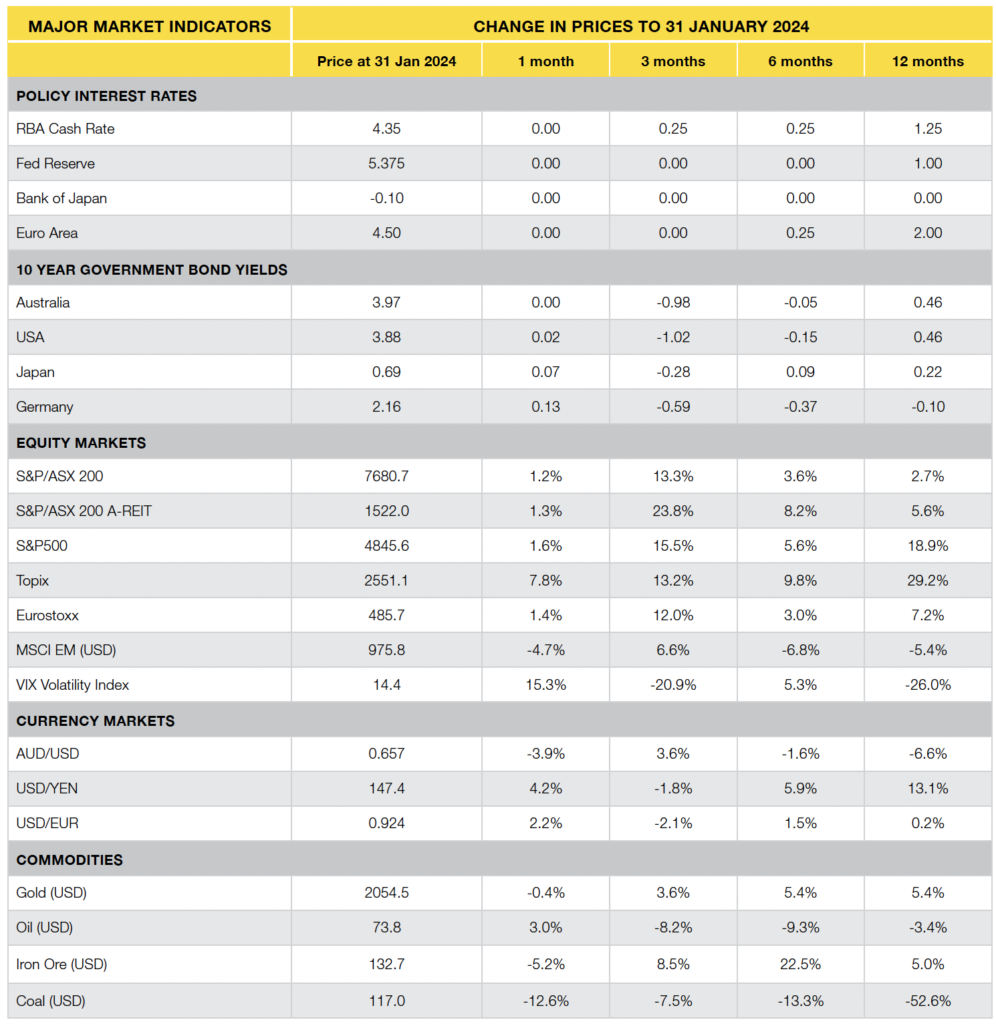

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Magnificent 7 Performance and Not-so Magnificent 493 (RHS)

Sources: Compustat, Goldman Sachs Global Investment Research

Sources: FactSet, Goldman Sachs Global Investment Research

Price to Earnings – USA, Australia, Emerging Markets & Global Growth vs Global Value

Last 20 Years to 31 Jan 2024

Regional Comparison – Equity Market Indices

Current Price to Earnings

Sources: MSCI

Regional Comparison – Equity Market Indices

Current Price to Earnings

Sources: MSCI

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026