This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

A tough month, a tough year, and it may not be over yet

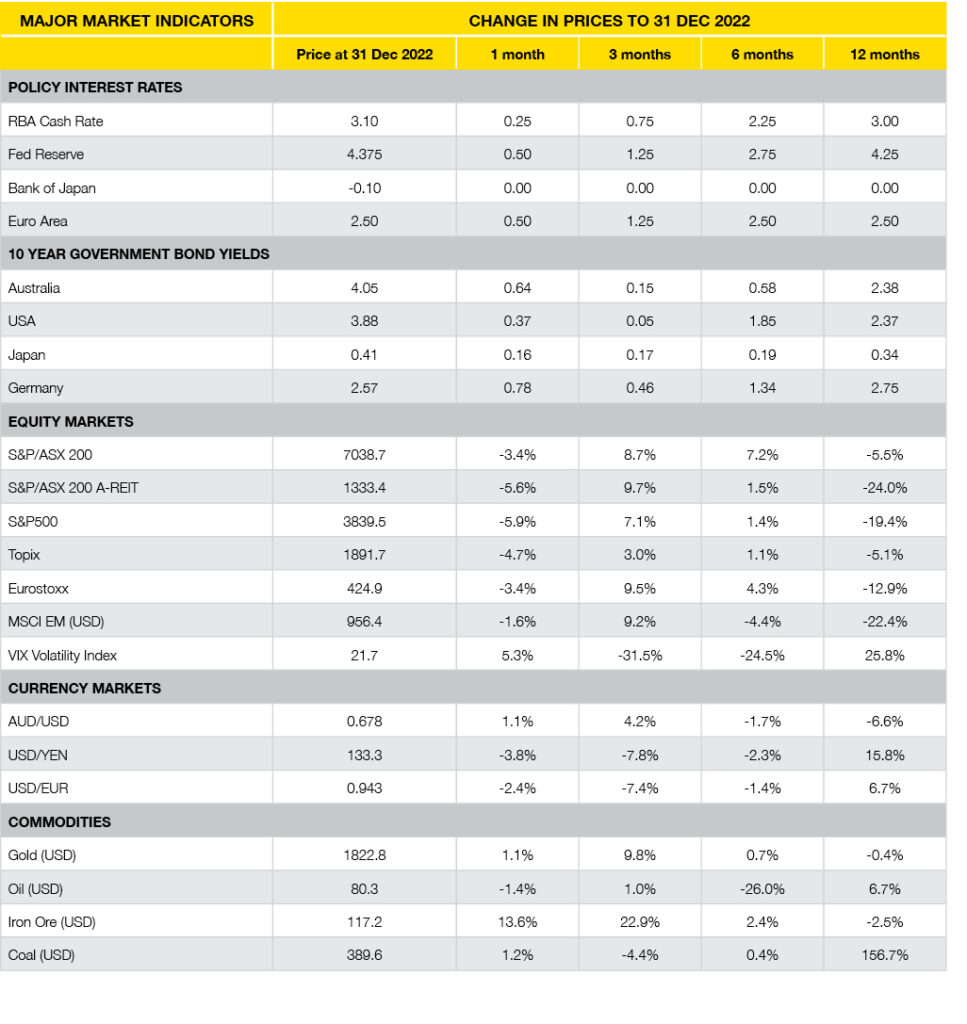

- Another difficult month as equity markets decline, bond yields increase, and central banks continue their higher interest rates to bring on recession and make inflation a thing of the past.

- In Australia the Reserve Bank have a month off in January, so there is respite before a potential 25bps rate risk in February. The Federal Reserve increased by 50bps in December, and they are likely to do the same at their next meeting in February.

- Looking ahead, our market expectations are unchanged from previous months. That is, investment market volatility will be high across all asset classes as the global economy slows down during the first half of 2023 and the readjustment continues.

- From a valuation perspective, we prefer underweight positions in the most expensive markets which continue to be US Equities (particularly growth/tech) and High Yield.

- Other preferences include high quality securities which are defined by good profitability and strong balance sheets.

- Whilst bond markets may be volatile, we believe they will provide some protection in 2023 and the horrible returns of 2022 are largely behind us.

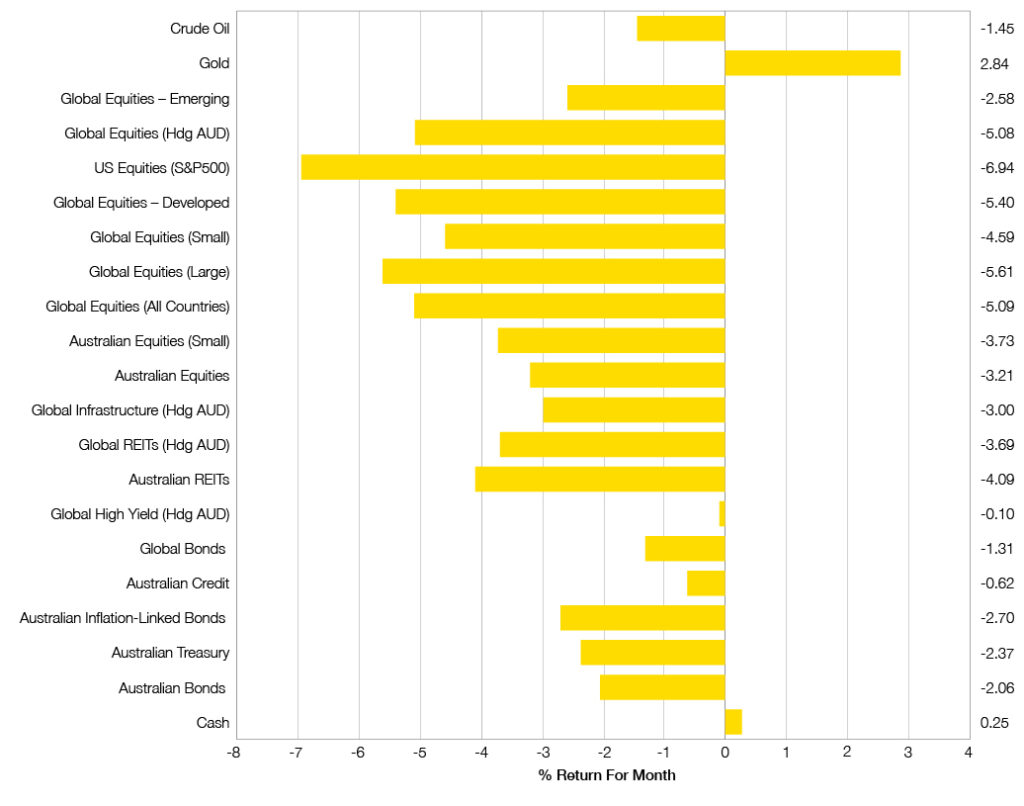

Chart 1: Hiding in Gold

Selected Market Returns in AUD – 31 December 2022

Sources: Morningstar

WHAT HAPPENED IN DECEMBER?

Markets & Economy

Finishing 2022 like it started … mostly in the red

- After a couple of strong months for most investment returns, December saw the return of higher volatility and negative returns for all major asset classes, except Gold (up ~3%) and Cash. So, the last month of the year finished very similarly to the first … mostly in the red.

- The economic catalyst for the negative returns in the latter half of 2022 continues to be the view that the USA will ultimately have a recession during 2023 as the Federal Reserve continues to increase their cash rates to sledgehammer inflation.

- US Equities (S&P 500) ended down almost 7% (in AUD) in December and this meant the calendar year of 2022 US equities were down 12.2% in AUD and down over 18% in USD, as the Australian dollar weakened against the US Dollar by almost 7%.

- Australian equities were amongst the best performers of 2022 and were only down by 1% for the calendar year thanks to strong commodity prices and better performance by the Big 4 banks that were helped by higher interest rates. That said, December still proved to be a difficult month and Australian equities were down 3.2% putting it in the red for 2022.

- 2022 will go down in history as the worst year ever for bond market returns. Whether Australian bonds or Global bonds, this previous “defensive” asset class produced negative 12% for the Global Bond market and the Australian Bond market (Ausbond Composite) was down almost 10%. This was obviously caused by sharply higher bond yields that anticipated cash rate rises by the RBA and Central banks of the world. Yields have settled in recent months.

- Despite the negativity of financial markets, major economies of the world have not shown strong signs of recession yet. Unemployment levels are still relatively low, and 2022 economic growth is positive. That said, financial markets are signalling recession is coming (negative US Yield Curve), and markets deemed the valuations at the start of 2022 were too high and an adjustment was required to coincide with the rising cost of money (i.e. cash interest rates).

Outlook

Sharemarket volatility is back and likely present for the first half of 2023

- Some economists are pointing to increased likelihood of a soft landing and no US recession in 2023. Whilst this is a real possibility of more importance are the actions of the US Federal Reserve and whilst they are communicating higher interest rates to combat inflation the likelihood of recession increases. This increases the likelihood of the following.

- Downgrades in corporate earnings, increase in unemployment, weaker Australian dollar, and continued downturn in property prices.

- Continued volatility for bond and equity markets … although the return outcome of bonds is highly unlikely to be anywhere near as bad as 2022, whilst valuations are still high the same cannot be said for equities as there are still significant downside risks.

- Widening of high yield spreads and likely negative returns for high yield. High Yield bonds have barely acknowledged the likelihood of recession and although spreads have widened in 2022, they are far from recession-like levels.

- Value stocks to outperform growth stocks again as valuations of global growth securities (particularly in the USA) continue to be very high.

- Commodity price direction could go either way but will depend on Russia’s war.

- As a result, there is no change in views from recent times

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

New Year, New Money Habits: What to Stop Doing in 2026

What a Financial Plan Actually Looks Like