This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

- High inflation in USA (8.5%), and Europe (7.5%) dominated markets worldwide resulting in higher bond yields and almost every asset class declining in value. Only Energy (Oil and Coal) appeared immune, but this was due to the continued Russian/Ukraine war and the fact their higher prices are part of the inflation problem.

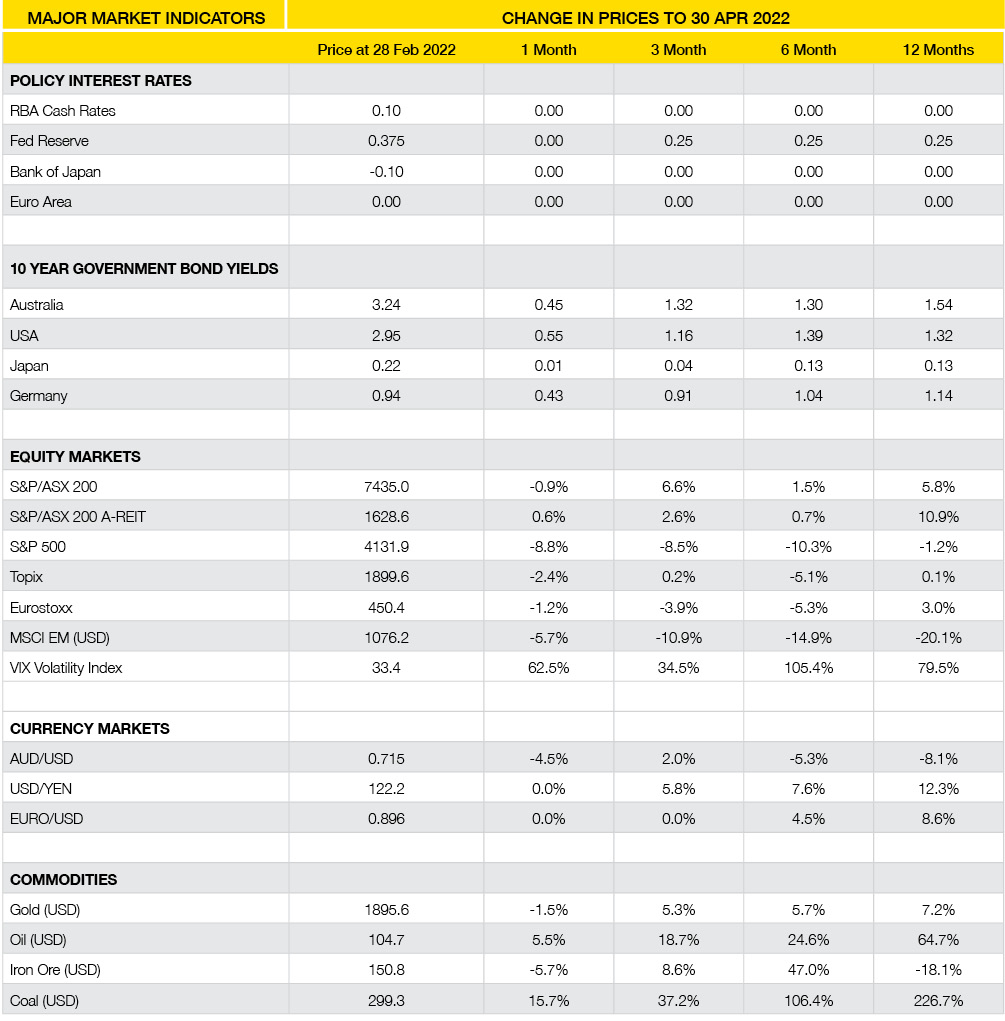

- Australia’s Reserve Bank (RBA) commenced their cash rate changes with a small, pre-election, 25bps increase and the US Federal Reserve increased for the second time in 2022 with 0.5% on top of its 0.25% increase in March.

- Equity markets are readjusting to higher inflation and higher bond yields; and securities with high valuations (e.g. USA, Growth, Tech, and ESG themes) have recently declined the most, whilst the old-school boring securities, like Banks and Materials, have faired best.

- Looking ahead it appears inflation will endure throughout 2022. The RBA believe Australia’s inflation will peak at 6% in December, it is similar overseas, and volatility across all financial markets should be expected.

- Whilst increasing cash rates will continue in 2022, significant care must be taken by Central banks as too much too quickly may strangle the economy and many of the price hikes (e.g. Food and Energy) are determined by factors that are out of central bank’s control.

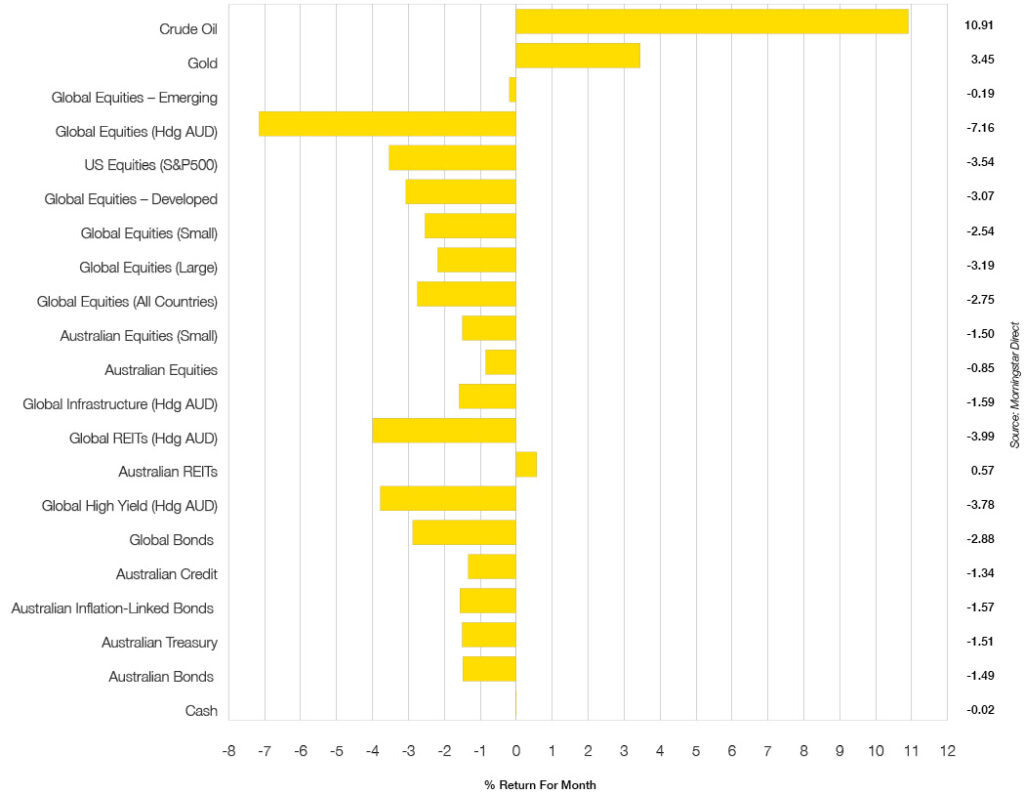

Chart 1: Another difficult month in traditional asset classes

Sources: Morningstar

WHAT HAPPENED IN APRIL?

Pandemic

No longer an economic focus

- COVID-19 is barely having an effect on global markets today, although it still exerts some influence in China where rising case numbers have resulted in lockdowns in Shanghai, thereby significantly reducing economic growth in one of the biggest cities in the world.

- The rest of the world is re-opening, cases and death rates are declining, and a return to near normal is well and truly underway. New variants are appearing but so far are not creating unexpected problems. All of that said, complacency is still the biggest COVID risk.

Markets

The wild ride continues

- Except for commodities, there were few places to hide for investors in April. Coal and Oil was up, and some assets (like Gold) increased in value as the Australian dollar declined almost 5% against the US Dollar.

- The only traditional index to increase for Australian investors was listed property where the S&P/ASX 200 A-REIT index increased by a measly 0.57%.

- Equity markets struggled as the Australian, Developed, and Emerging Markets all declined (-1%, -7%, and -0.2%, respectively). The continued massive increases in bond yields resulted in further losses across all forms of debt.

- Global High Yield and Global Bonds declined the most (down almost 4% and 3%, respectively), whilst all Australian Debt declined a little over 1%.

- Central Banks increased cash rates all around the world as high inflation continued. At the time of writing (6 May 2022), US Federal Reserve have increased its Cash Rates by 0.75% this year, Australia’s RBA increased by 0.25% for the first time in over 10 years, and Canada and New Zealand’s central banks both increased by 0.50%. Tackling inflation is the goal but balancing economic growth outcomes will be difficult as not all inflation can be controlled.

Economy

US Stagflation

- The last few weeks saw the USA produce concerning economic numbers which have also contributed to global financial market volatility. Inflation continues at multi-decade highs and has now increased to 8.5%, whilst the March quarter Real GDP declined by 1.4%, which is a short-term form of stagflation (i.e. high inflation and recession).

- European inflation is at 7.5%, UK inflation at 7%, and cash rates are expected to increase there too.

- The Reserve Bank of Australia (RBA) believes Australian inflation will peak at 6% in December 2022 and has increased its cash rate much earlier than previously indicated as high wages growth has not yet appeared.

- Inflation appears to be all that matters for now, although the weak USA Real GDP provides an early sign of what it can do to an economy if control is lost.

- The major challenge for central banks today, is to reduce the inflation it can control without destroying their economies. For example, food and energy prices are largely determined by global markets and there is currently a war between two major energy and food producers.

Outlook

- It appears along with inflation, 2022 will likely be seen as a very volatile year for all markets. The higher bond yields are resulting in large shifts across equity markets as expensive securities are sold off and the previous momentum of growth, tech, and ESG-friendly themes are replaced by lower valued, lower growth (some may call) boring securities.

- Valuations remain high in USA and still carry downside risks. Whilst Emerging Markets’ valuations continue their appeal, they carry a unique set of risks in the form of China with their continued lockdowns and potential government crackdowns on markets.

- With many bonds, both high and low risk, providing yields well above inflation, it is possible the worst is behind us. Whilst it is sometimes difficult to take the contrarian view, rebalancing portfolios appears to be prudent if taking a long-term view.

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026