This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

Goldilocks is having a good run.

- Strong sharemarkets have continued for a fourth month and lead by strong corporate results including NVIDIA’s which created the biggest one-day gain in history … $255US Billion!!!

- NVIDA’s strong results pulled many technology companies and risky assets along for the ride. Even Bitcoin appears to be back, priced over $60,000USD by the end of February … an almost 50% gain for the month!!

- As mentioned last month, despite the US Sharemarket suggesting everything is great, US Bond Yields are still negatively sloping (which was an 8 from 8 recession predictor) and pointing to lower cash rates in the second half of 2024.

- Economic growth slowdown is expected in 2024, so should be accompanied by lower cash rates … but not yet as inflation is still a little too high, the economic data is not quite bad enough, and central banks have said no rate decreases yet.

- Whilst we were wrong on the US Market over 2023, valuation is retained as our long-term anchor as it rarely fails over the long term. Economic weakness exists in Europe, Asia, and even parts of Australia, so any signs of weakness in the USA may produce short term pain.

- With both bull and bear market signals everywhere, there are no obvious places to invest, just places to avoid. Emerging Markets and Global Small Companies appear good value, but they still come with significant risks. As a result, portfolio preferences continue to be towards diversification across asset classes and securities.

Chart 1: Momentum maintained across all asset classes to finish the year

Selected Market Returns in AUD – 29 February 2024

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

- It was another strong month for equities, and this was supported by largely strong company earnings results and continued economic resilience out of the US.

- With artificial intelligence (AI) the theme du jour, the results of the AI darling NVIDIA were critical as to whether market strength continues or not. After announcing its earnings towards the end of February, it set a new record single day rally increasing its market capitalisation by a whopping $277Billion USD. Increasing the value of NVIDIA by more than the combined value of Australia’s 3 largest banks, CBA, NAB, and Westpac … and it has continued to rally since!

- The Federal Reserve and the Reserve Bank of Australia both signalled they had little intention to decrease cash rates in the short term, so bond yields increased a little resulting in flat to negative returns for fixed interest investments.

- Unemployment remains low in the USA at 3.9% and in Australia (4.1%) but is increasing slowly. Many have expected unemployment to be much higher due to the massive increase in interest rates but so far this is not the case.

- China, Europe, and now Japan’s economies continue to struggle. China is loosening their monetary policy with lower cash rates and quantitative easing, whilst Europe and Japan have held firm on any monetary policy action, and cash rates are unmoved.

- The biggest surprise across markets has been the continued recent strength of Australia REITs. From one of the worst performing asset classes, they have recently bounced back to become the best over the last few months. This was originally triggered by the prospect of lower interest rates, but despite the change in RBA messaging, price momentum has continued.

Outlook

There is no change …

- 2024 is generally expected to be a weaker global economy than 2023 and is priced for lower cash rates in the second half. That doesn’t mean it’s time to increase allocation to risky assets as a weaker economy is often a difficult time for risky assets, but we appear to be nearing an inflexion point where the focus shifts from high inflation to weak economic output. Therefore, diversification continues to be essential.

- Whilst potentially sounding like a broken record, sharemarket valuations are near record highs in the USA, and particularly amongst the big tech companies, so long-term upside potential must be limited. Sharemarkets have only been priced more expensively around 10% of the time. As mentioned previously, this comment is specifically for the long-term … anything can happen next month, and momentum is a powerful force in markets!

- Bond prices have settled a little over the last couple of months, and we expect them to provide greater diversification to the sharemarket in 2024 as the focus shifts from inflation to the economy.

- High Yield corporate debt continues to appear expensive, and we believe there are better places to achieve higher risk-adjusted returns, and we prefer investment grade debt.

- With Cash rates yielding higher than bonds, cash continues to be appeal.

- Investing with styles that favour value, quality (whether bonds or equities) also appears appropriate but no matter the preferred market, portfolio diversification is crucial.

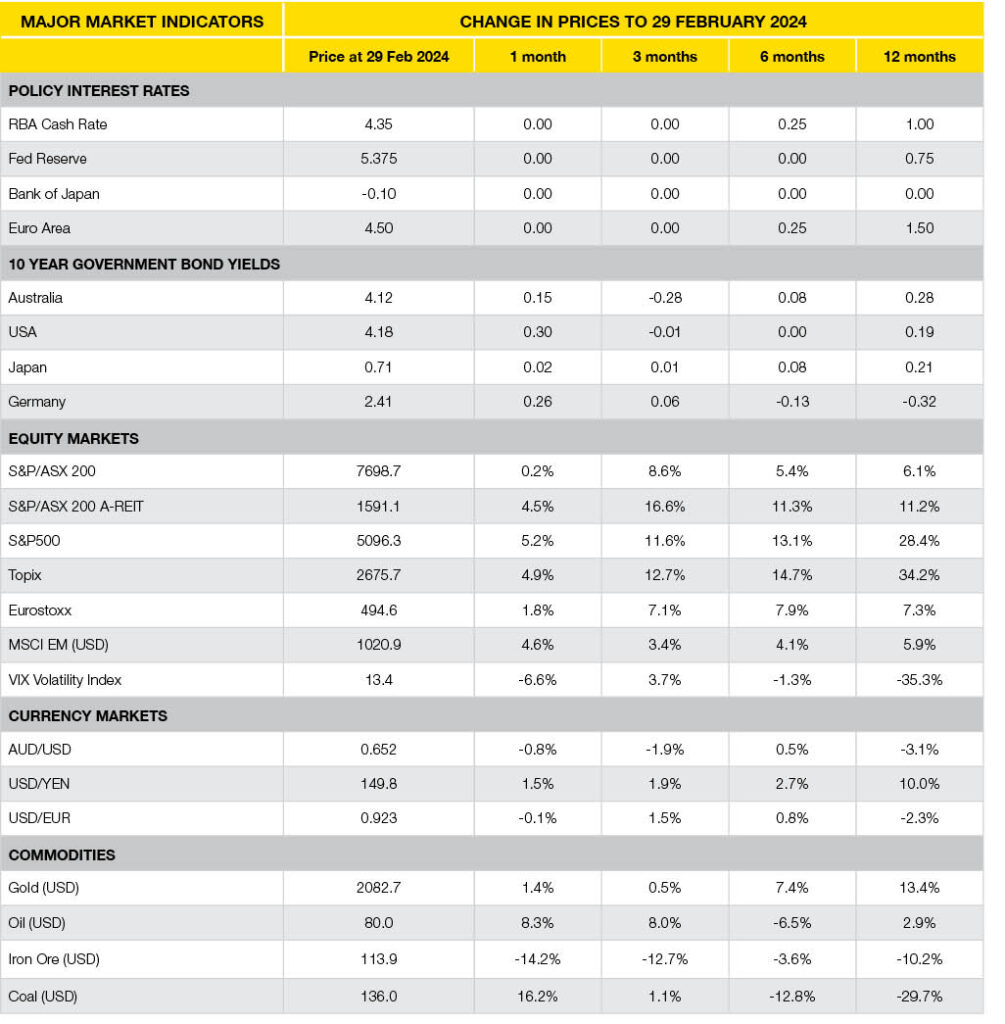

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Real Gross Household Disposable Income Per Capita

Sources: Michael Read. Source: OECD; Financial Review

Price to Earnings – USA, Australia, Emerging Markets & Global Growth vs Global Value

Last 20 Years to 29 Feb 2024

Sources: MSCI

Latest News Articles

Back to Latest News

How to Create a Family Budget That Actually Works

What Happens If You Can’t Work? An Income Protection Checklist