This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

The prospect of lower cash rates meant December was “risk-on”

- The last two months have seen the continuation of stronger than expected economic results in the USA (& Australia) combined with sustained higher cash rates; but most importantly, lower inflation. China and Europe are exceptions and are both showing economic weakness.

- US Bond Yields are still negative sloping (which was an 8 from 8 recession predictor) and are suggesting declining cash rates in 2024, as there is belief the inflation beast has been tamed.

- Equity markets have confidently agreed and ended 2023 on a positive rampage … particularly for growth stocks, that includes the biggest US companies (e.g. Apple, Tesla, et al.).

- Looking ahead, the mixed results from markets and strong risky asset returns leading to historically high valuations maintain our caution. That said, our view is high volatility continues as the focus increasingly turns away from inflation to the economy during 2024. Considering 2024 is an election year in the USA, economic strength will be a major focus of newspapers with risks of misinformation, particularly given it usually determines election outcomes.

- Either way, the primary market risk is US recession and particularly given high USA sharemarket valuations. With both bull and bear market signals everywhere there is no obvious place to invest. Portfolio preferences continue to be towards broad asset class and security diversification and avoidance of concentrated bets … particularly on strong recent performing assets.

Chart 1: Momentum maintained across all asset classes to finish the year

Selected Market Returns in AUD – 31 December 2023

Sources: Morningstar

WHAT HAPPENED LAST MONTH?

Markets & Economy

Lower cash rates the dominant theme in December

- Another very strong month for equity markets and other risky assets as the prospects for lower cash rates in 2024 due to low inflation gained momentum.

- During December, the best performing asset classes included 2023 laggards like Australian and Global REITs. Investors in these interest rate sensitive assets felt the prospect of lower cash rates in 2024 would be advantageous and Australian REITs increased by 11.5% and Global REITs by 8.4% in December 2023 alone. Austrlaian equities also increased an impressive 7.3% (refer Chart 1).

- After almost reaching 5% in October 2023, 10-year bond yields in Australia and USA have decreased to below 4%, which would usually suggest economic weakness, which in a sense it does because lower cash rates are only likely to occur if an economy is under threat … but certainly lower cash rates won’t accompany and economy that is booming.

- The most recent inflation results in USA showed 3.1% to the end of November, and with unemployment still low at 3.7%, a soft landing and the avoidance of recession is increasingly being agreed by economists. In Australia, inflation is still at a relatively high 5.4% (thanks to services inflation), but unemployment remains low at 3.9%

- China’s economy is showing relatively low economic growth levels (4.9% vs previous 6.5%), inflation remains negative (-0.5%), and unemployment is stable at 5%. The Chinese government is providing stimulus, and deflation (the opposite of inflation) does present as it’s biggest economic concern.

- Europe is currently in recession, and inflation has dropped massively and is around 2.9%. Unemployment is steady at 6.5%, and this is all despite relatively strong equity markets in 2023 that produced around 20% returns (in local currency terms).

Outlook

The focus is now economic (i.e. less so inflation)

- A weaker economic outlook supported by lower and negatively sloping bond yields, combined with strong risky asset prices suggest the mixed messages from markets continue.

- Whilst it is agreed the likelihood for lower cash rates augurs well for risky asset valuations, these valuations are already very high in the USA so long-term upside potential is limited.

- Bond prices have increased significantly, and both November and December were so strong that further cash rate reductions only occurs if economic weakness comes to the forefront. Either way, we expect bonds to provide greater diversification to the sharemarket into 2024 and the focus in 2024 will be the economy … particularly given its USA election year.

- From a sharemarket valuation perspective, there isn’t a great deal of change. Investment markets at greatest risk continue to be the growth-heavy US Tech and Growth market and we start 2024 not too different from 2022 (which didn’t go too well). Refer Page 4.

- It is worth noting (again!!!) that High Yield spreads are currently near their lowest levels since interest rates started increasing in 2022 and higher yielding corporate bonds do not currently appear to provide good long-term value.

- All of that said, despite forecasts, Cash rates are still unlikely to decline in the next few months and an overweight position (if already held) appears appropriate as economic risks remain.

- Investing with styles that favour value, quality (whether bonds or equities) also appears appropriate along with the avoidance of concentrated bets in favour of diversification.

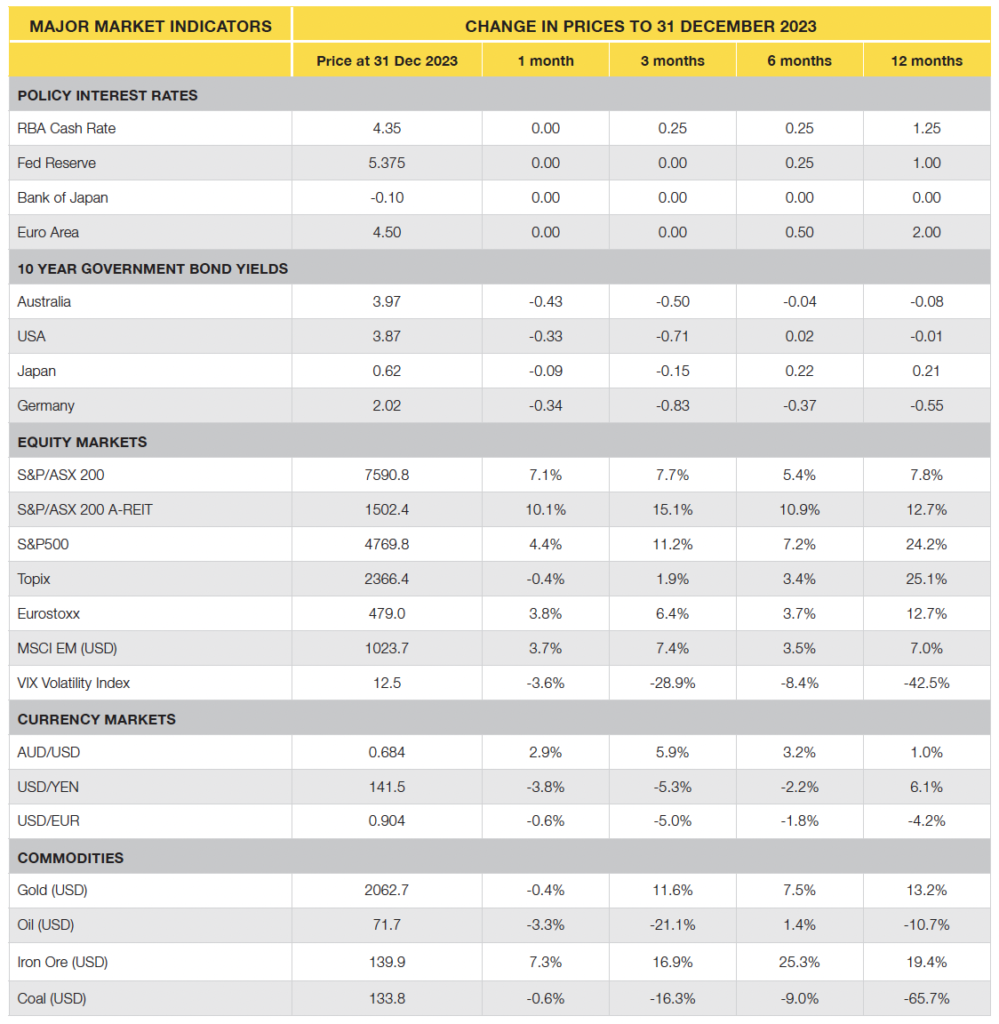

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

The Setup for the S&P 500 (US Market) is very similar to how we entered 2022

Here is a breakdown of percentile readings comparing December 2021 to present conditions:

- Valuations: 91st percentile now compared to 89th in December 2021

- Positioning: 82nd percentile now compared to 89th in December 2021

- Sentiment: 66th percentile now compared to 74th in December 2021

- Fundamentals: 60th percentile (as in non-supportive) now compared to 76th in December 2021

- Technicals: 88th percentile overbought now compared to 65th in December 2021

Chart 2: S&P 500

United States (indext)

Sources: Rosenberg Research

Eerily similar to December 2021 and remember what 2022 looked like. Back then, it was about interest rates. For 2024, it will be about what said interest rates are set to unleash with a classic lag on the economy and earnings.

Latest News Articles

Back to Latest News

How to Create a Family Budget That Actually Works

What Happens If You Can’t Work? An Income Protection Checklist