This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

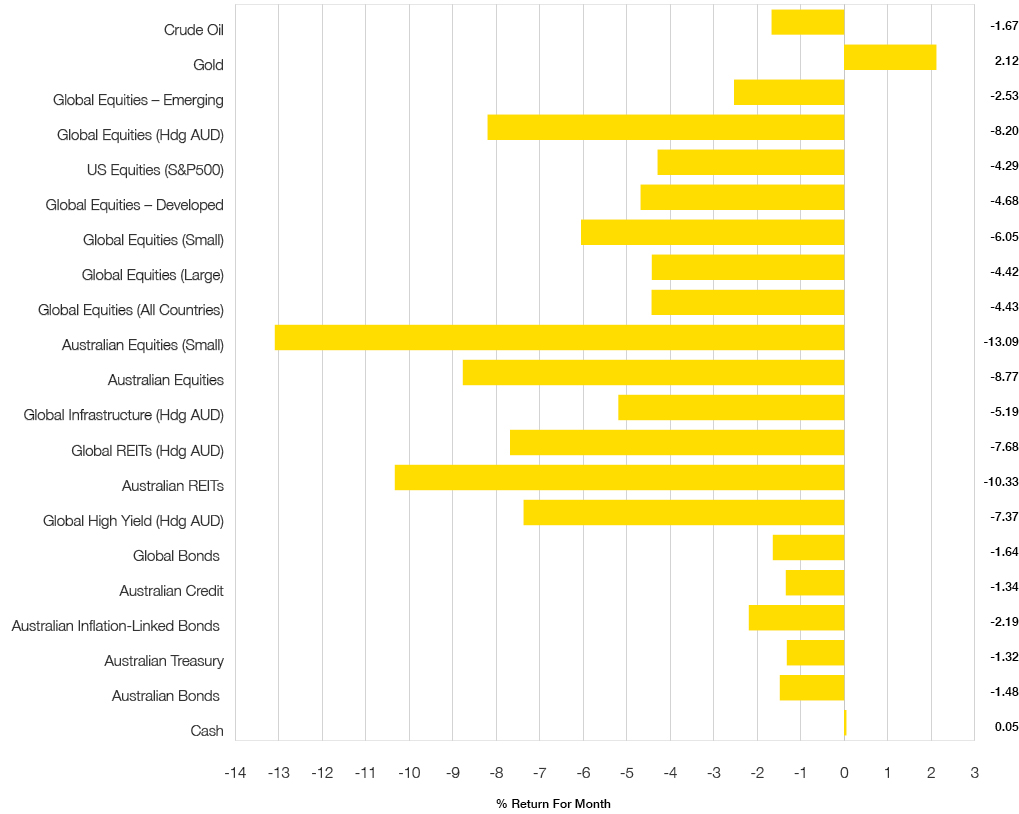

- The first half of 2022 will go down as one of the most challenging investment periods in history as all asset classes (except Cash), produced large negative returns. As Chart 1 shows, June was bad on its own. Aside from record low earning cash returns, there have been few places to hide in 2022.

- As we all know, the major reasons have been the multi-decade record high inflation coming out of USA, Europe, and exacerbated by the Russian/Ukraine war which placed upward price pressure on Food and Energy. Countries requiring the import of food and energy are likely already in recession and talk of recession for the developed world has started.

- Markets are pricing in cash rate increases around the world, and in Australia, markets expect cash rates to increase to 3% within 12 months which will place strain on the economy given the high mortgage rates on top of high food and energy prices.

- It is difficult to see the rest of 2022 produce anything but more financial market volatility, our preferred overweights continue to be cheaper value-style equity and high-quality bonds (i.e. Investment Grade).

- On the positive, compared to a few months ago, the future expected returns for all asset classes are much higher but prudent investing in risky assets absolutely requires diversification (not concentrated bets) and patience for a long-term view.

Chart 1: Another difficult month in traditional asset classes

Sources: Morningstar

WHAT HAPPENED IN JUNE?

Markets & Economy

Volatility is the norm as bond yields soar

- As reported just a few weeks ago, headline inflation in the USA (8.6%) created a market rout in the second week of June, as everyone knew the outcome is higher interest rates from Central Banks but at the cost of a weaker economy than previously expected.

- With high food and energy prices feeding into inflation (exacerbated by the continuing Russia/Ukraine war), higher interest rates will only have a limited effect on reducing prices, meaning it is discretionary goods and services that are hit hardest as households prepare for lower savings and businesses are challenged with reducing profit margins.

- Unfortunately, the natural outcome to unexpected higher inflation was always massive volatility across all financial markets, whether bonds, equities, commodities, and property. More unexpected high inflation will do the same.

- Amongst equities, it was the previous (2020/21) darling growth markets that were hit hardest, whilst the cheaper value style securities (including Emerging Markets) were the better performers (as opposed to 2021).

- When markets are stressed, the US Dollar usually strengthens, and the month of June was no different and the Australian dollar now trades at ~$0.68USD which is down from $0.71USD. This ~4% reduction in value aided unhedged investors in diversified global equity portfolios that are dominated by US securities…so losses were reduced.

Pandemic

A new variant and increasing cases

- Whilst the pandemic has fallen down this page in term so of priority, it is still a major risk as reports of a new contagious Omicron variant that is likely vaccine resistant has surfaced in recent weeks. Thankfully death rates are not high (yet) so it may be a weaker variant but surging cases are keeping businesses and health professionals challenged and calls of returning mask mandates appear sensible over the short term (just in case “weaker” is a false assumption).

Outlook

Inflation Everywhere

- Unfortunately, this paper continues to leave the remaining points unchanged from previous months …

- It appears along with inflation, 2022 will likely be seen as a very volatile year for all markets.

- The higher bond yields are resulting in large shifts across equity markets as expensive securities are sold off and the previous momentum of growth, tech, and ESG-friendly themes are replaced by lower valued, lower growth (some may call) boring securities.

- Valuations (still) remain high in USA and therefore carry downside risks. Whilst Emerging Markets’ valuations continue their appeal, they carry a unique set of risks in the form of China with their continued COVID lockdowns and potential government crackdowns on markets.

- Long term bonds are currently much higher than in 2021 and whilst the short-term losses have been painful, this is where the safest returns appear … as any recession could result in lower yields (which translate to price increases) as cash rates increase to combat inflation.

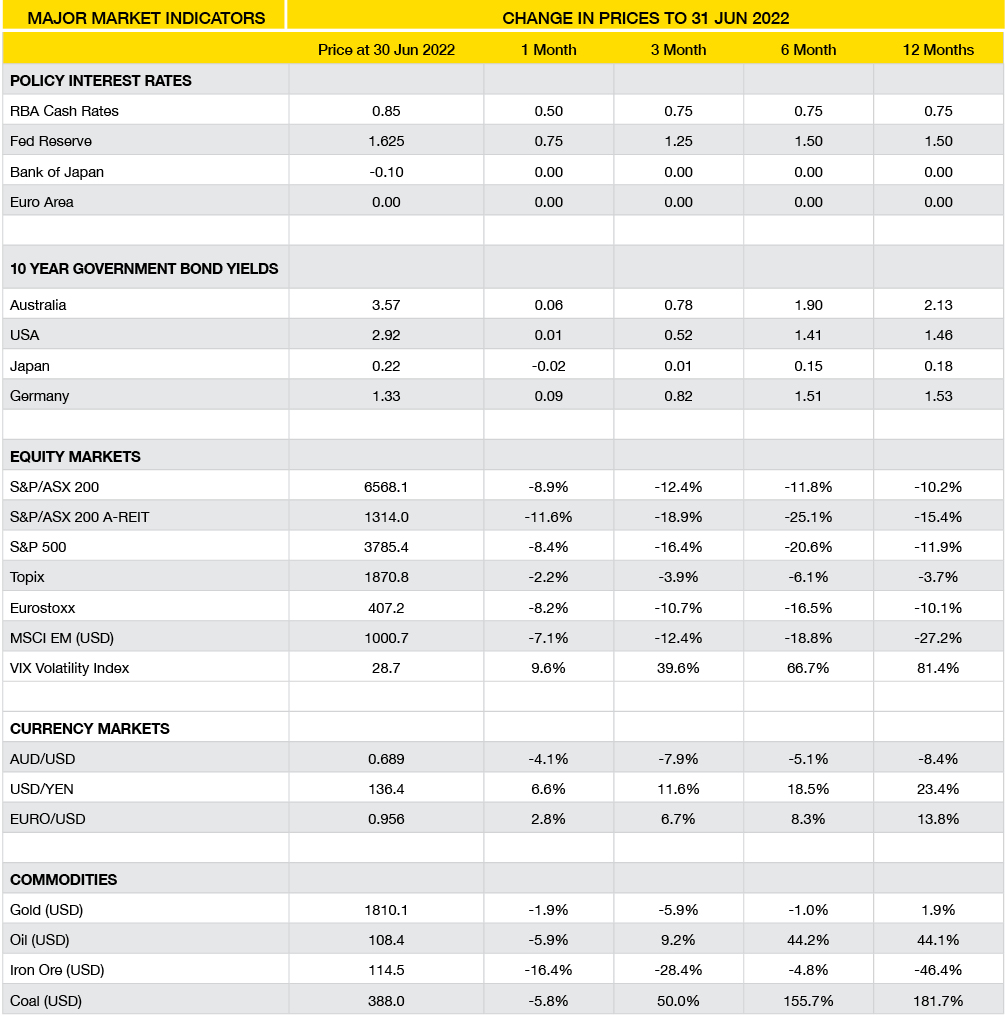

Major Market Indicators

Sources: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

How to Create a Family Budget That Actually Works

What Happens If You Can’t Work? An Income Protection Checklist