This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

IN SUMMARY

- Omicron is now the dominant news story around the world as daily Global COVID cases are at record highs (currently greater than 2 million) and health systems and governments appear to be losing some control. On the positive side, it is a milder COVID variant which combined with stronger levels of vaccination is resulting in lower deaths and hopefully a stronger shift towards some level of herd immunity and a return to normal.

- Emerging Markets continue to lag, and this is due to investors fleeing China as the Evergrande (Property Developer) collapse spreads towards other Chinese companies. From a long-term perspective, a diversified allocation to Emerging Markets continues to present strong return potential as valuations are appealing continue to be significantly lower than larger developed markets such as USA.

- Looking ahead, the combination of high US equity market valuations, low bond yields, the rapidly spreading Omicron variant, and inflation concerns from continued supply chain problems all points towards high market volatility suggesting a diversified portfolio of multiple asset classes and regular rebalancing is most prudent.

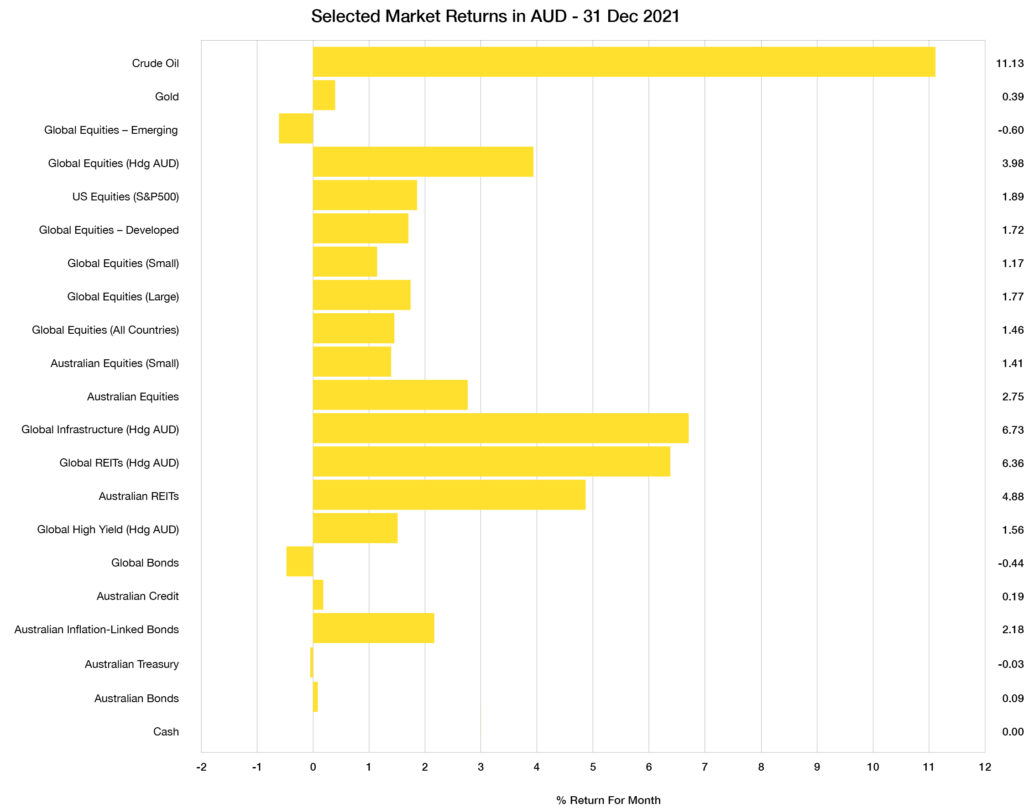

Chart 1: A month for Real Assets

Source: Morningstar Direct

WHAT HAPPENED IN DECEMBER?

Pandemic

Omicron takes over from Delta as variant of concern

- A month can be a long time in a pandemic and in November Omicron was an ‘early days’ variant of concern and December it dominated the world spreading at speeds not seen before.

- Whilst Omicron is regarded as less dangerous than earlier variants, the sheer volume of new cases are resulting in higher hospitalisations, greater numbers in isolation, and appears likely to slow economic growth in regions that are unprepared and/or unvaccinated.

Markets

Low interest rates and inflation fears … A good month for Real Assets

- Fears about inflation were a persistent theme during December and somewhat unsurprisingly resulted in a good month for Real Assets including Australian REITs (up almost 5%), Global REITs, and Global Infrastructure (both up over 6%).

- Consistent with this included the best performing fixed interest sub-asset class being Australian Inflation Linked Bonds which were up over 2% in December. This contrasts with a slightly negative or zero return for Global Bonds (Hedged to Australian Dollars), Australian Bonds, Australian Treasuries, and Australian Credit.

- Except for Emerging Markets (relatively flat), equity markets were generally positive with the bigger contributions coming from Europe (Eurostoxx up over 5%) and USA (S&P500 up over 4%).

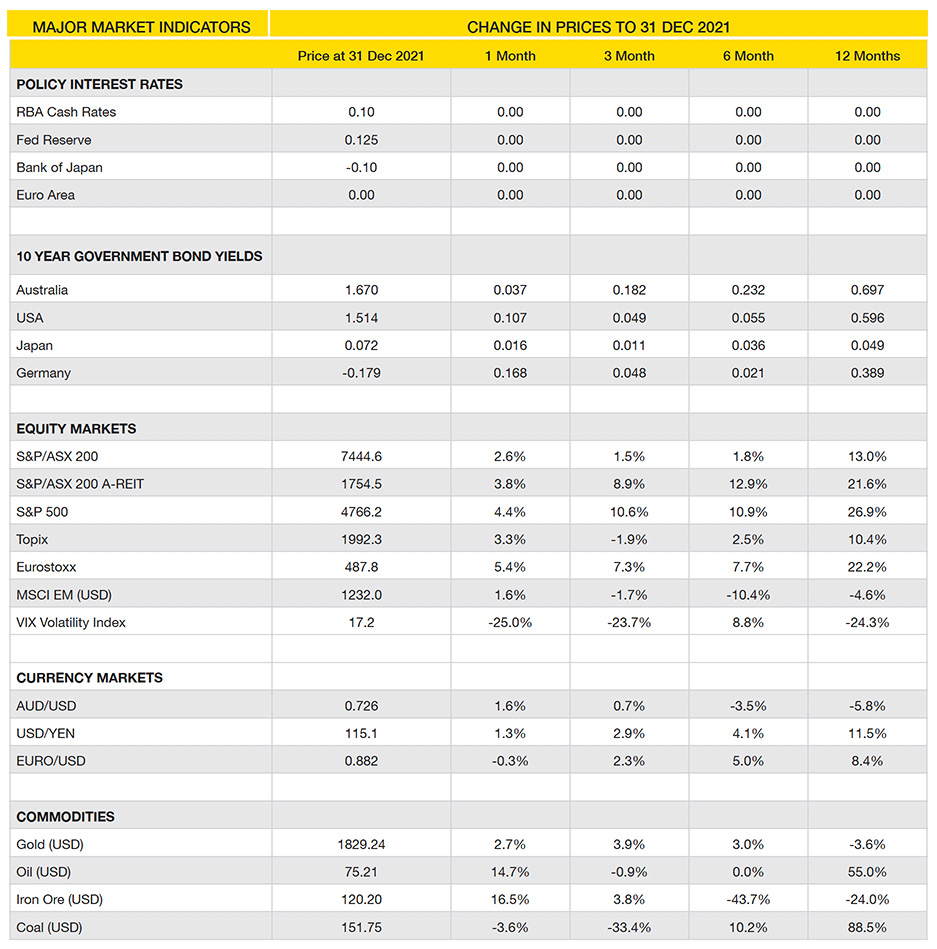

- These positive results were also consistent with a reduction in the “Fear” VIX index which declined 25% and is down to (a still relatively high) value of 17.

- With Iron Ore and Australian Bond Yields increasing in Australia, this provided support for the Australian dollar which stopped its previous slide ending up a little over 1% to $0.726USD.

- Equity markets were mixed for October with the already expensive US Market recommencing its momentum and returning a very high 6.9%.

- After a poor performing November, Oil bounced back almost 15% to close at $75USD per barrel and this help with reducing inflation fears.

- For the 2021 year, all equity markets finished up in AUD terms, whilst most investment grade bond markets finishing flat or down. 2021 was another year for risky assets in this low interest rate environment.

Economies

Inflation still high with mixed economic results

- There was very little change in economic news around the world during December as inflation fears continue to be the big concern whilst bond markets disagreed as yields stayed low.

- That said, the Australian Bureau of Statistics did release the September quarterly GDP results for Australia which showed a better-than-expected economic result of -1.90% in Real GDP change. This was due to the pandemic lockdowns in NSW and Victoria but many economists expected the result to be much worse.

- Unemployment in Australia (4.6%) and around the world (USA = 4.2%, Euro Area 7.3%) is generally low and its main threat is largely related to the spread of the Omicron and another vaccine resistant variant.

Outlook

- Whilst the relative mildness of Omicron provides light at the end of the pandemic tunnel, its rapid spread still provides significant short term economic uncertainty as the global number of cases has increased from less than 500,000 per day back in October to over 2 million today.

- This increased pandemic uncertainty, the increased potential for vaccine-resistant variants, combined with continued expensive equity markets (particularly in the USA) all builds the case for increased volatility in equity markets.

- That said, low bond yields and inflation fears continue to mount the strongest case for a portfolio of multi-asset diversification and regular rebalancing which provides a systematic way of selling high and hopefully buying low.

Major Market Indicators

Source: Tradingview, Morningstar, Trading Economics, Reserve Bank of Australia

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026