This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

PANDEMIC

- At the time of writing much of NSW and SE Qld are in lockdown and it appears NSW will be for some weeks as community transmission continues from the highly contagious Delta variant and contact tracing struggles to keep up.

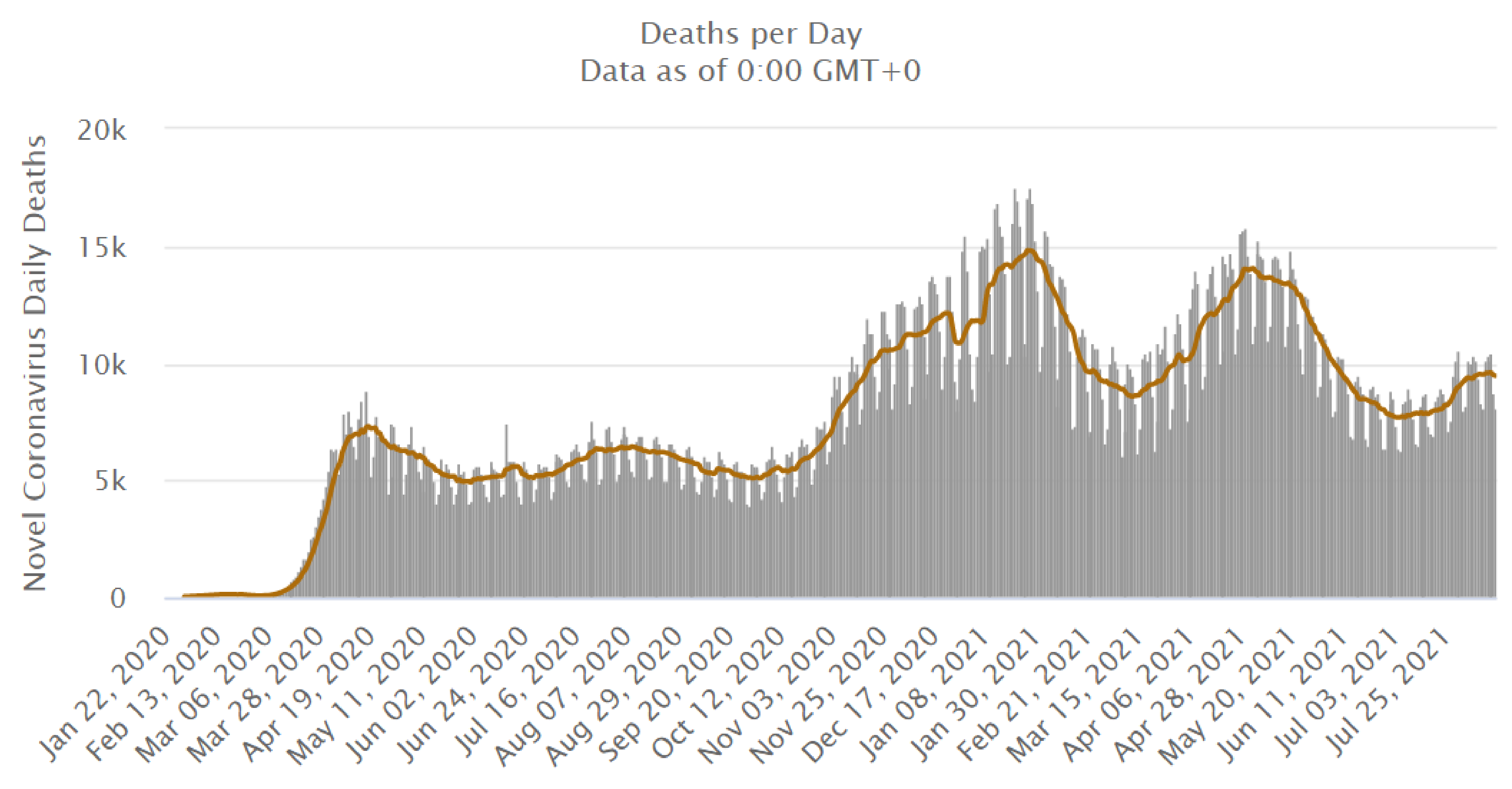

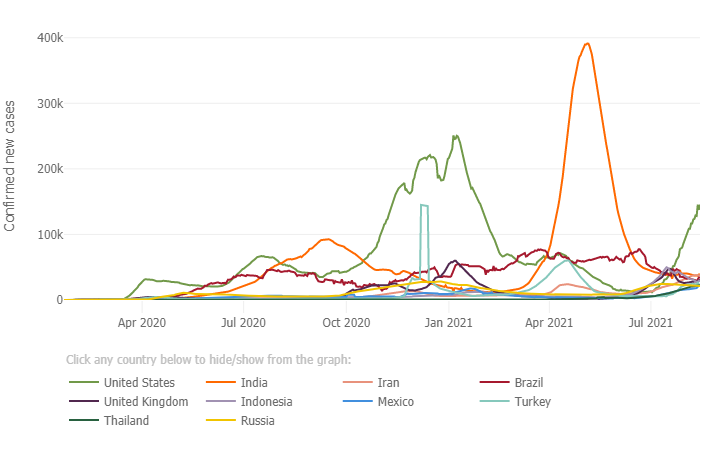

- Globally, the situation is still bad, with thousands dying every day and hundreds of thousands of new cases every day. That said, the overall numbers are the best for over 12 months and the trends are generally good as vaccination is proving to be effective.

- Risky assets continued their strong return momentum for another month with monetary and fiscal stimulus still strong drivers of most risky markets.

- At the time of writing there are only two nations (UK and Israel) with vaccination rates above 50% so there is a long way to go for herd immunity to kick in (if it does at all).

- UK have reduced their restrictions which may add risks towards greater transmission and concerns of a vaccine-defiant variant as herd immunity is still some way off.

Daily global deaths new cases Covid-19

Source: www.worldometer.com

Daily confirmed new cases (7 day moving average)

Source: John Hopkins University of Medicine

Geopolitical

- Significant Geopolitical tensions likely to impact global markets (e.g. US-China relations) appear to largely be on hold but as nations continue their inward focus on controlling the virus. Of most significance was rhetoric from the USA implying the source of COVID-19 could have been from a Chinese laboratory.

- From an Australian perspective, China have indicated their likelihood to purchase less Iron Ore from Australia in the future and has placed some downward pressure on Iron Ore prices which may weaken the Australian dollar.

Global Economy

- The second quarter of 2021 GDP results are coming through, and the results are generally good.

- USA has produced a strong 6.5% real economic growth quarter and the Year-on-Year (YoY) result is a whopping 12.2%. This is higher than China s which was 1.3% for the quarter which created a YoY of a still strong 7.9%.

- The Euro area is now out of recession and the last 12 months, economic growth was 13.7%.

- Whilst these numbers are all way above long term averages, it is worth noting they are recoveries from the sharpest economic decline which occurred during the June quarter of 2020.

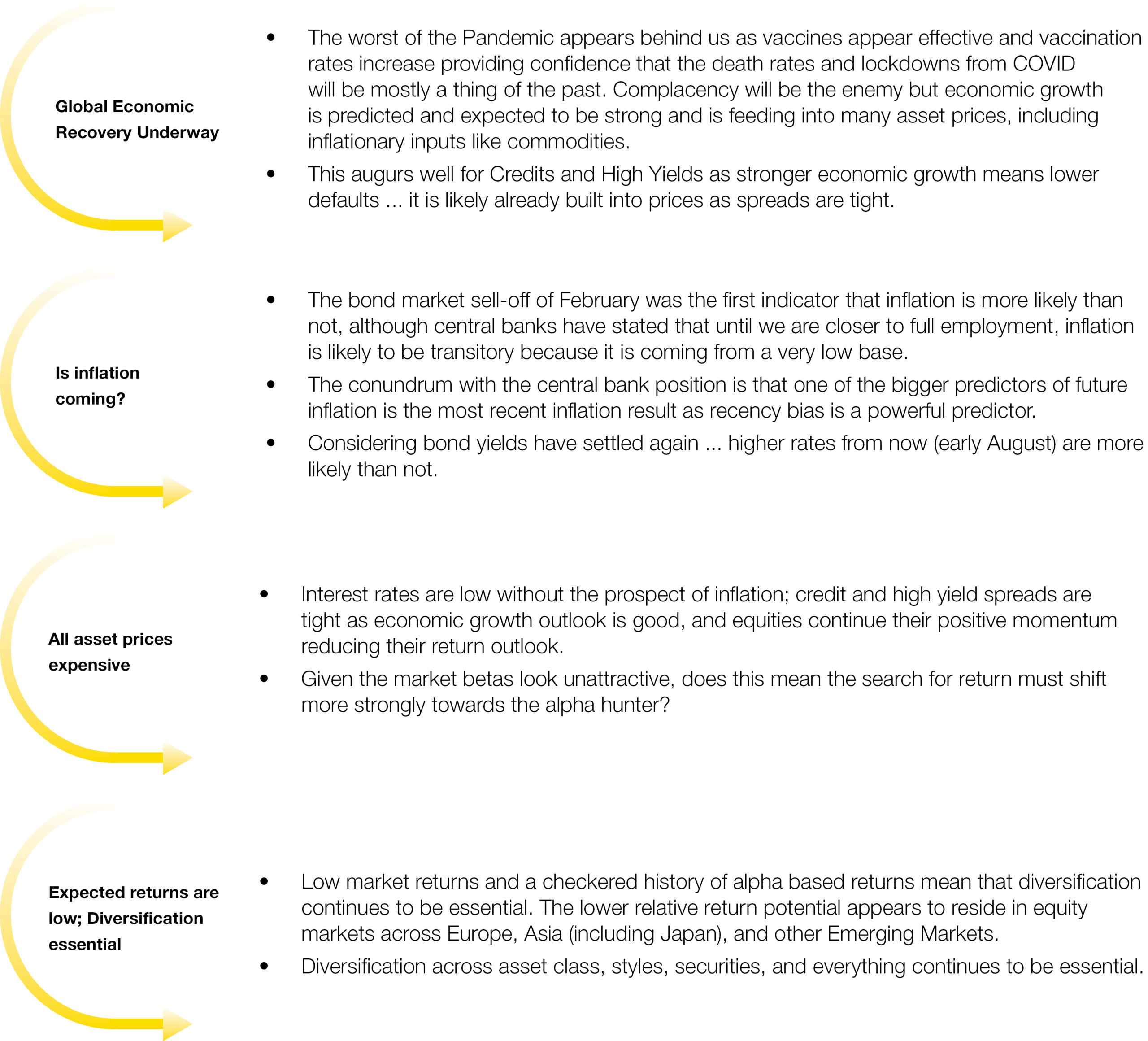

- Looking ahead, the vaccine programs continue to create optimism for the global economy in 2021 and 2022 and higher vaccination levels are required before many economies will have the confidence to completely open up.

- The jury is still out on inflation and whilst USA managed a high recent 5.4% result most of that was purely due to price increases in Used Cars (up 45%) and Transportation Services (up ~10.4%).

- Latest European and Chinese inflation is well under 2.5%

Economies

Australia posts another positive quarter

- Australia has posted another positive GDP quarter (for March 2021) and spending is now back to Pre-Pandemic levels.

- All Central Banks are keeping their low interest rate regime as they believe market’s concerns about inflation are not sustainable and they continue to wait for actual sustainable inflation which they don’t expect before 2024.

- Whilst China and Australia post good economic results for March, Europe has stayed in recession as the Euro Area posted a negative GDP result for March.

Global Markets

- The performance in the 3 months to end of July was generally good for global risky assets (Global Equities up more than 10% in AUD) as the vaccination roll-out gave momentum towards a positive outlook around the world.

- The one exception was Emerging Markets which dropped 5.2% (USD terms) after a 7% decline in July which was due to a significant sell-off in China.

- The constant growth of Developed markets, particularly USA, continues to reduce forward expected returns. USA appears to be the most expensive market with Emerging Markets looking best value.

- Bond yields have almost returned to the late February lows as markets are slowly coming to the conclusion that the inflation fears of February/March are likely transitory which is the belief of most central banks.

- Over the last few months, the US Dollar has generally strengthened, changing direction after around 12 months of weakness.

Global Risks

- Whilst the major risk to markets stays the same, i.e. the current pandemic, the type of risk has changed to the ability of the vaccines to work against new variants of COVID-19. So far, they appear to be relatively effective against the dominant Delta but with vaccine levels so low, this strain continues to be rampant.

- Obviously, global recovery and increased immunity to COVID-19 will result in a return to a somewhat normal life and global economy again but I still looks like at least a year or two away.

- Whilst cash and bond yields stay at low levels the current historically high equity market valuations, particularly in the USA, are likely sustainable in the near term.

Australian Economy

- The strength of the Australian economy has weakened significantly in the face of lockdowns in all mainland capital cities. Most economists are expecting a decline in economic activity for the September quarter and economic growth forecasts have declined from 4.5% for 2021 down to around 4%.

- The Australian economy showed a positive 1.8% growth rate for the March quarter which followed a solid 3.1% growth for December quarter and GDP over the last 12 months is positive again at 1.1%

- Unemployment in Australia continues to improve, and latest figures (June 2021) are at 4.9% which is significantly better than early COVID projections which were expected to be over 8.5%, and the lowest level for around 10 years.

- Whilst Australia has kept COVID-19 case and death rates very low, the vaccination program has started off poorly and continues to splutter along. Higher vaccination is clearly required to keep on top of these increasingly contagious variants.

Australian Markets

- The Australian equity markets (S&P/ASX200) finished up over 5% for the 3 months to 31 July but like in the USA, prices are looking expensive and reliant and reliant on continued monetary and fiscal expansion.

- This is the markets way of saying that sustained inflation is looking less likely and/or the economy is looking weaker.

Australian Risks

- Current risks around the Australian economy continues to local and global COVID-19 situation which will dictate lockdowns, and the timing of opening borders with other trading nations.

- China’s threats around tariffs and reducing purchase of Iron Ore appear to be increasing. The increased rhetoric around the cause of COVID being an outbreak from a Wuhan lab won’t help (although it is a current worldwide belief).

- Equity markets are also looking very expensive, although investors are likely to continue accepting risk whilst defensive assets appear to yield below inflation expectations.

Latest News Articles

Back to Latest News

What a Financial Plan Actually Looks Like

Realistic Budgeting Tips for Australians in 2026