This article was prepared by Michael Furey, Principal of Delta Research & Advisory, on behalf of HPartners Group.

In summary

- The Global COVID-19 situation has improved significantly in May although Australia has recently served a complacency warning around vaccination slowness with a two-week lockdown in Melbourne.

- Bond markets were stable in May and inflation fears have settled with it. Central Banks are currently unconcerned about sustainable inflation and markets appear to be waiting for the next relevant inflation-related economic data.

- Overall, all risky assets produced strong results for the second month in a row, which continues the confidence in the vaccines and a move towards potential normal economy.

- Looking ahead, the main message from last message continues as the current strong US Fiscal stimulus, continued loose monetary policy from Central Banks around the world, improving outlook for COVID-19 vaccines, and higher economic growth expectations have provided a lot of support for the risky assets over the short term.

- Of course, the downside risks remain around equity market valuations and there is current preference for Value-styled strategies.

- Our portfolios have maintained their neutral position on risky assets and, where appropriate, have rebalanced away from cash assets towards higher yielding bonds.

What happened in May?

Pandemic

Vaccine Rollout Continues

- As the vaccine rollout continues around the world some of the hotspots continue to calm in terms of new cases and deaths. This is particularly the case in India where at its peak there were around 400,000 new cases per day but is now down to around 130,000.

- Australia is currently serving as somewhat of a reminder that complacency should not be tolerated. The vaccination rollout has been full of misinformation and mixed messages and the current 14-day lockdown in Melbourne serves as a reminder that getting vaccinated should be a priority for everyone.

- COVID-19 continues to be the biggest influence on the global economic outlook and the overall current improving trend is creating momentum behind confidence in recovery.

Markets

Nothing but positive for 2 months in a row

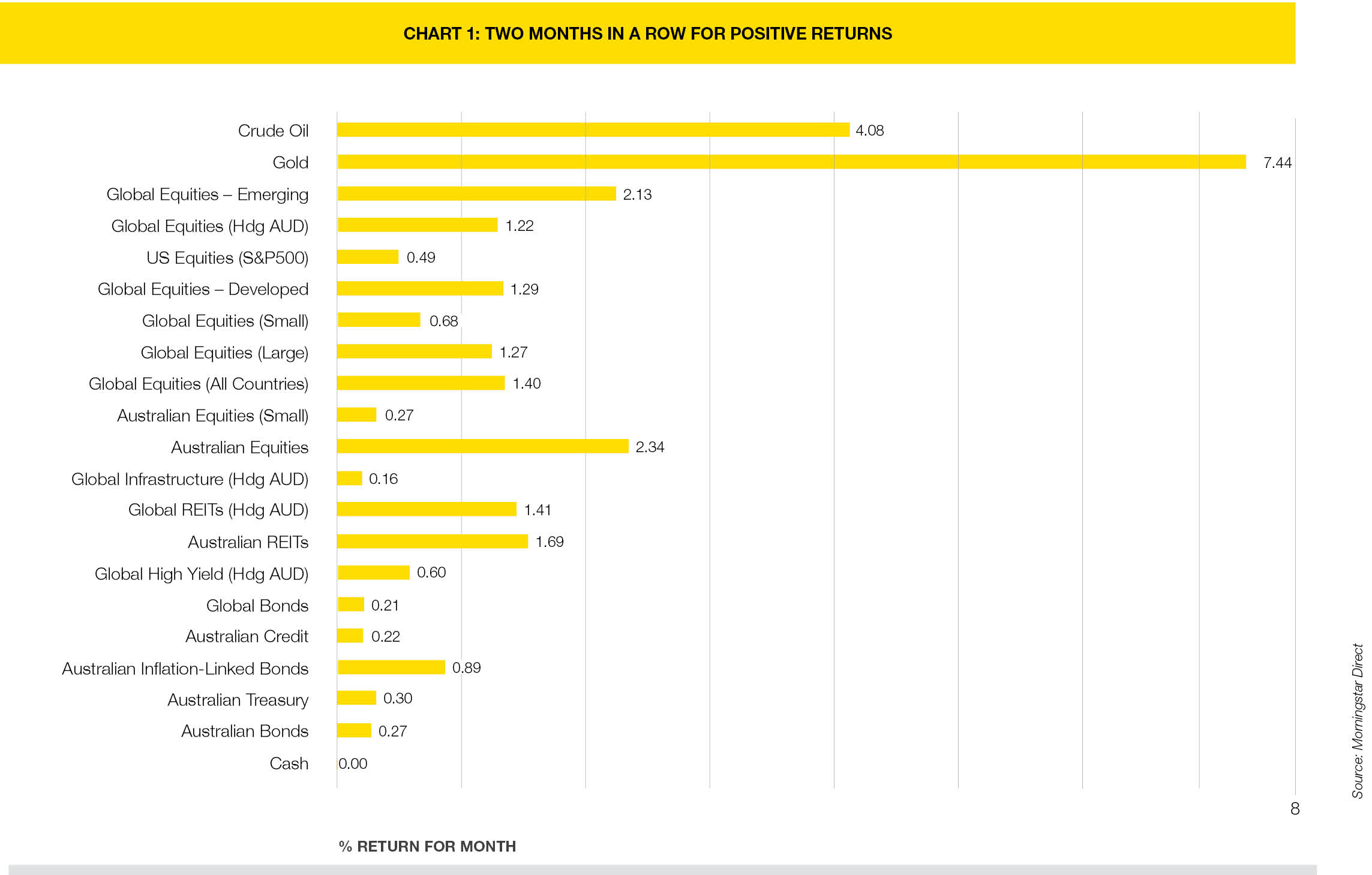

- As Chart 1 shows, Gold was a strong performer with a return of over 7.4% for the month of May. Gold is one of those hedging assets, that is often used as a hedge for inflation (which seems to be the current market concern), sometimes a hedge for equities, and often a hedge to the US Dollar.

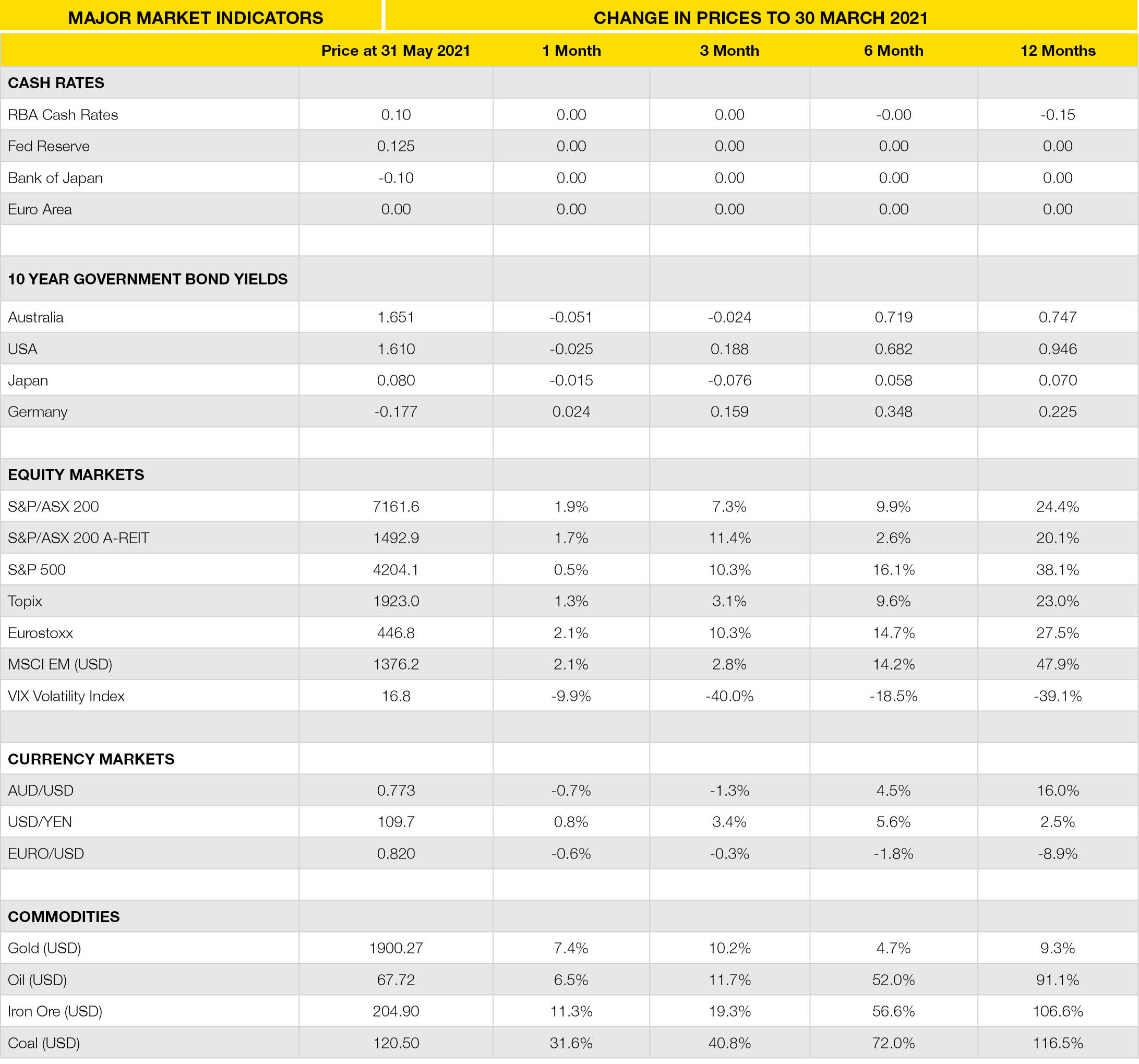

- Despite concerns about inflation, bonds have further settled in April and yields generally decreased. The difference between the higher yielding US and Australian 10 Year Bond is very little and are both currently yielding between 1.6% and 1.7%.

- Equity markets continued their increase with major markets, including Australia, returning around 2% for May. Joe Biden’s massive Fiscal Stimulus is behind much of the sharemarket confidence and appears to have created some positive momentum.

- The higher prices mean valuations are even higher and the US Market appears the one that is at most downside risk from valuation exuberance.

- Australia’s budget also produced a further fiscal expansion which may also add to sharemarket confidence as the budget deficit increases and places more cash in the system

Economies

Australia posts another positive quarter

- Australia has posted another positive GDP quarter (for March 2021) and spending is now back to Pre-Pandemic levels.

- All Central Banks are keeping their low interest rate regime as they believe market’s concerns about inflation are not sustainable and they continue to wait for actual sustainable inflation which they don’t expect before 2024.

- Whilst China and Australia post good economic results for March, Europe has stayed in recession as the Euro Area posted a negative GDP result for March.

Outlook

- Month to month this year the key message has barely changed.

- The economic outlook for the world and its biggest economy, USA, is very strong. This has been supported by markets which have supported growth assets whilst longer term bond yields have largely settled but at slightly higher levels since the start of the year.

- The vaccination rollout continues but a truly normal global economy won’t exist for a year or two yet. Wider and more accessible vaccination rollouts must be completely global and not just for rich nations. Increased production and broad cooperation is essential.

- From a portfolio perspective, positions remain unchanged… the slightly higher bond yields previously resulted in a preferred shift away from low interest rate cash and towards bonds. Given high equity market valuations, there has been little incentive to increase allocations towards these risky assets and maintaining a neutral position between risky and not-risky assets is preferred for now (although higher equity market volatility would be unsurprising).

Latest News Articles

Back to Latest News

End-of-Year Money Checklist: 10 Things To Do Before NYE

Redundancies in Australia Rising Quietly in White-Collar Sectors