Global Economy

- Global economic growth continues but significant market volatility during August and early October in bond and equity markets has signalled potential recession in the not so distant future for major developed economies. This is supported by continued downgrades to economic growth from major economic institutions and central banks, and economic data surprises to the downside (e.g. weak US Payroll data and ISM (Manufacturing) data).

- At its mid-September meeting, the US Federal Reserve reduced its cash rate from 2% to 1.75%; cutting for the second time in 2019. This was done “to help keep the US economy strong in the face of some notable developments and to provide insurance against ongoing risks”. Recent issues include a number of global geopolitical risks such as the continued Trade War with China and tariffs on European goods (e.g. aircraft) that has resulted in weaker US business investment and exports.

- Major economies in Europe are on the cusp of technical recession and have most recently recorded a negative quarter of real GDP. This includes Germany, UK, and Russia. The ECB announced a reduction in its cash rate to a record low -0.50%, yes that is negative, and announced a new quantitative easing stimulus plan whereby it will buy around 20billion Euro of bonds per month.

- The major contributing factors to lower global economic growth are primarily geopolitical in nature and include the trade war between China and USA, which appears to be dragging on much longer than many originally anticipated and has few signs of abating.

- Other geopolitical issues include Brexit, which is likely to occur without an agreement at the end of October, potential US/Iran military action that has continued for some months and is on a knife edge following the bombing of oil infrastructure in Saudi Arabia, US/Mexico, and US/Japan trade tariffs that all appear likely as Donald Trump doubles down following criticism from economic and political leaders around the world.

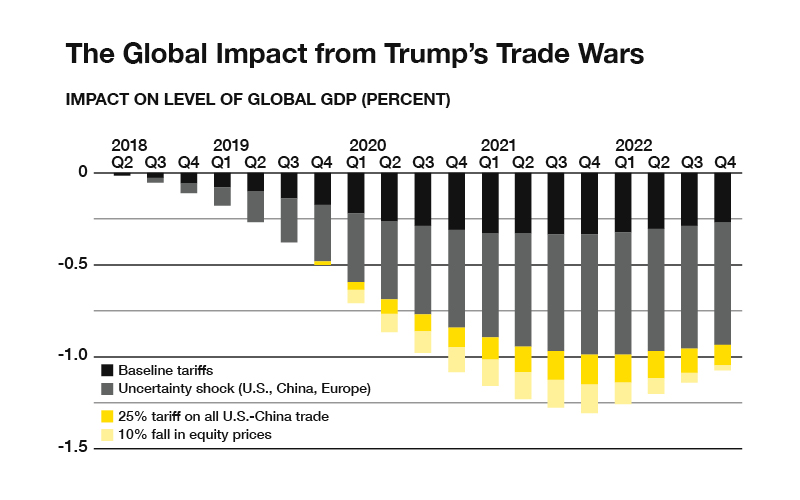

- Bloomberg forecast that 25% tariffs on all Chinese imports to the USA are likely to produce a reduction in global economic growth of up to 1.0% within 2 years. Current tariffs are also expected to be a significant drag on the global economy and this trade war rhetoric will continue to produce market volatility any time tariffs appear to get worse.

Global Markets

Global Markets

- Market response to the Trade Wars in August has seen the strongest levels of equity market volatility during 2019 and stronger than the previous small correction in May. Weak data in October resulted in a two day decline of around 3% in S&P500.

- One of the earlier volatility catalysts was the US Government Bond yield curve shifting towards negative slope. When the US 10 Year Yield minus 2 Year Yield has turned negative, a recession has followed within 2 years for each of the last 6 recessions back to the 1960s. This has been dismissed by many market pundits, and it may not be a strong indicator for local economies like Australia, but it’s too early to dismiss and the economic data appears to be weakening.

- Whilst August has been volatile, 2019 has still brought very strong returns for all asset classes, whether bonds or equities. Looking ahead, with valuations high for all major asset classes, investors should temper their future return expectations.

Global Risks

- Global market risk continues to primarily lie with the above-mentioned geopolitical issues which are mostly driven by USA. Namely, continued Trade war between USA, China; USA, Europe; and potentially USA, Mexico.

- Europe’s economy continues to be fragile with their own geopolitical challenges including Brexit, and Italy’s ballooning deficit, weakening banking sector, and fragile government coalition. PMI data point to a strong likelihood of a technical recession (Less than 50% of Purchasing Managers predict growth in orders).

Australian Economy

- Australia’s economic growth has reduced to its lowest level since the GFC recording annual real GDP of 1.4% for the June 2019 quarter. This is the weakest growth result since the September quarter of 2009 which was also Australia’s weakest annual result over the GFC period.

- Other economic statistics started to weaken over the last quarter, with inflation at a continued low 1.6%, well below the RBA’s 2% to 3% target, and unemployment creeping up to 5.3% (Aug 2019) after reaching a low 4.9% in Feb 2019.

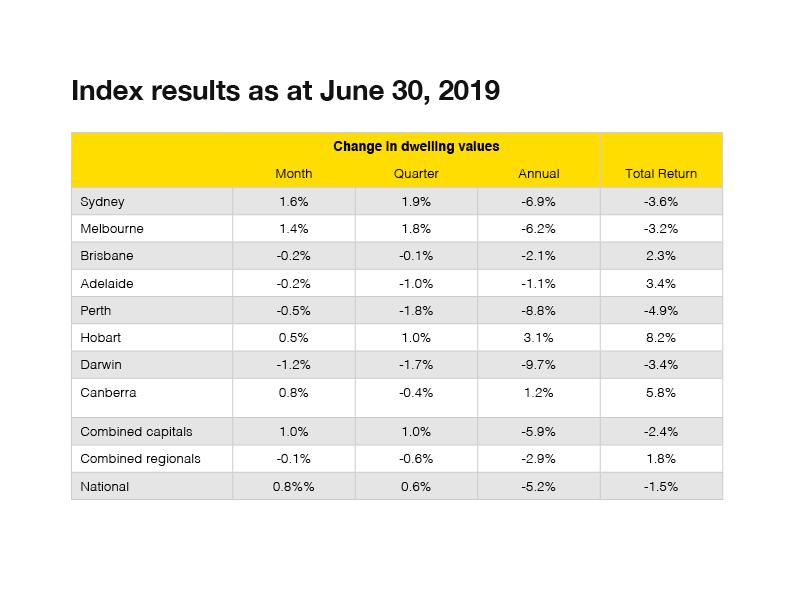

- Aside from global effects, the primary driver of the weak results has been the decline in housing markets across Australia which have resulted in loss of confidence, perceived wealth, and therefore reduced spending. That said, the recent reduction in cash rates by the RBA has produced early signs of improving confidence.

Australian Risks

- Chinese economic success will be a major driver of Australia’s economic success for many years to come so continued Trade Wars between China and USA is a major risk to Australia in the short term.

- Many commentators are saying the worst of the housing slump is behind us, however this is off the back of limited data and assumptions of the impacts of the Reserve Bank’s rate cuts. Either way, the housing market continues to be a major risk and unemployment continues to the most significant indicator.

Australian Markets

- The weaker Australian economic resulted in the Reserve Bank changing its cash rate for the first time since August 2016. June, July, and now October meetings resulted in 25 basis point reductions down to a record low rate of 0.75%.

- Bond markets have reduced their yields significantly and recently hit record lows. At the time of writing, 2-year to 5-year bond yields are currently trading a little over 0.6%, and the 10-year yield is around 0.9%. All suggesting the market still believes a strong chance of more Reserve Bank rate cuts and likely down to 0.5%, at least.

- With interest rates at record lows, the sharemarket has reasonable valuations. Performance is volatile but unchanged over the last 3 months.

Latest News Articles

Back to Latest News

End-of-Year Money Checklist: 10 Things To Do Before NYE

Redundancies in Australia Rising Quietly in White-Collar Sectors